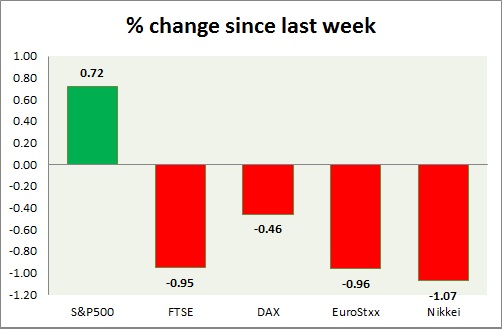

Equities are all trading in red today. Kindly note all instruments mentioned here are CFDs, whose values might differ from cash or future traded. Performance this week at a glance in chart & table -

S&P 500 -

- S&P 500 is marginally down as investors pull out money after hawkish FOMC last night. Today's range 2079-2091.

- Flash reading showed US GDP grew at 1.5% annualized pace in third quarter.

- S&P 500 future is currently trading at 2087. Immediate support lies at 2120 and resistance 2020.

FTSE -

- FTSE is down driven by global selling. Today's range 6450-6350.

- Next target for FTSE is around 5600 and then 5200. Upside target is coming around 6720.

- FTSE is currently trading at 6390. Immediate support lies at 6270 and resistance 6820.

DAX -

- DAX is sharply down as ECB optimism fades. Today's range 10740-10910.

- DAX is currently trading at 10790. Immediate support lies at, 9850 area and resistance at 11500 around.

EuroStxx50 -

- Stocks across Europe are red today.

- German DAX is down (-1.06%), France's CAC40 is down (-1%), Italy's FTSE MIB is down (-1.2%), Spain's IBEX is down (-0.65%).

- EuroStxx50 is currently trading at 3406, down by -1.2% today. Support lies at 3200 and resistance at 3550.

Nikkei -

- Nikkei is down in line with global selling. Focus on tomorrow's BOJ monetary policy Today's range 18800-19170

- Nikkei is currently trading at 18920, with support around 18000 and resistance at 19600, 20600.

|

S&P500 |

+0.72% |

|

FTSE |

-0.95% |

|

DAX |

-0.46% |

|

EuroStxx50 |

-0.96% |

|

Nikkei |

-1.07% |

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings