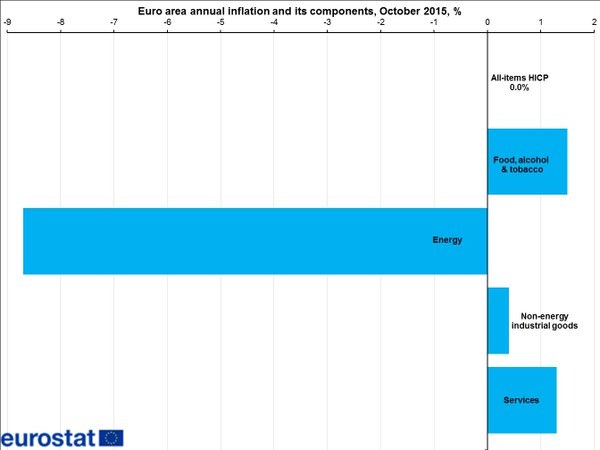

According to latest report from European Union for preliminary inflation reading for October, energy is exerting too much drag on Euro zone inflation.

It is not that inflation is quite high or close to European Central Bank's (ECB) close to but below 2% target range but it is also not as bad as headline number suggests.

- Preliminary reading showed while headline inflation number remained at zero, core components grew at 1% from a year ago.

- Processed food, Alcohol and Tobacco prices grew 0.6%, unprocessed food grew by 2.3%, non-energy industrial goods grew at 0.4% and services inflation at 1.3%. But energy remains large drag, deflating -8.7%.

According to latest report, several Euro zone member countries such as Italy, Germany exit deflation in October according to flash estimate, however that is unlikely to prevent ECB from further easing the policy.

President Draghi has indicated that European Central Bank's (ECB) mandate is for headline inflation, which is very low at the moment.

Next ECB meeting is scheduled on December 3rd.

Euro is up against Dollar today, trading at 1.102

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?