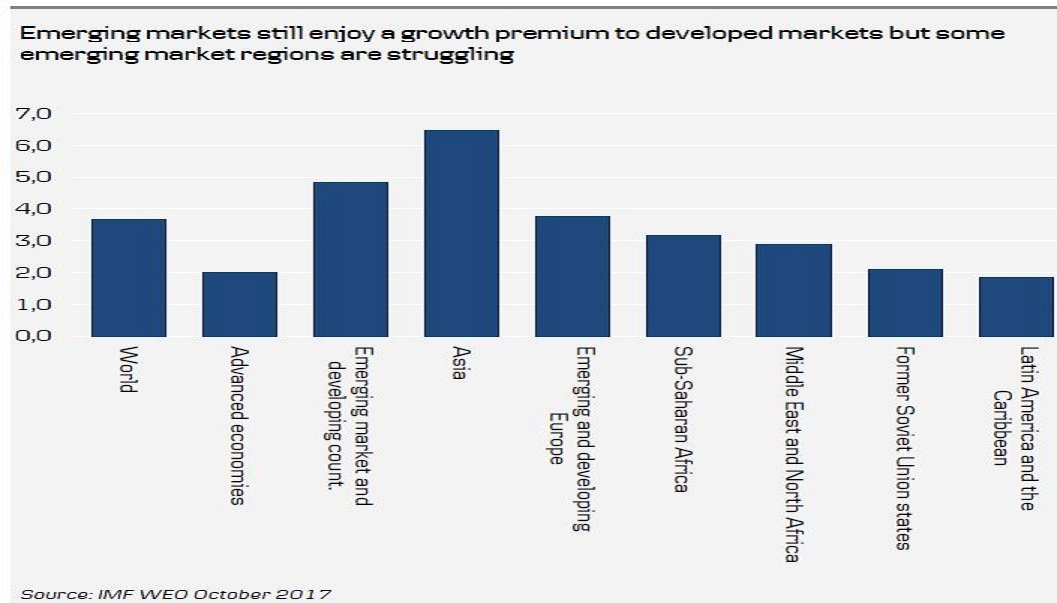

The emerging market economies are expected to witness an average growth of 5 percent over the next two years, according to a recent report from Danske Bank. While advanced economies should be happy to record an average growth rate of 2 percent over the next two years, emerging markets are expected to witness almost 5 percent on average. The strongest growth outlook is in Asian countries but Eastern European and African countries are also expected to grow quickly.

In contrast, Russia and the rest of the former Soviet Union are struggling with a relatively weak growth outlook, as are many Latin American countries. Among the most uplifting meetings at the meetings was the one on India, where the IMF projects the economy’s growth potential is around 7.5 percent thanks to a relatively young population, structural reforms (tax reform and bank re-capitalization), relatively low debt (in contrast with China) and macroeconomic stability.

The same goes more or less for the Indonesian economy. In contrast, the IMF saw relatively subdued long-term growth potential for the Russian economy (due to weak productivity growth (due to state controls in the economy) and a declining population), Brazil (where the debt overhang from the boom years in the private sector is weighing on growth) and South Africa (given structural and fiscal obstacles).

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Australian Pension Funds Boost Currency Hedging as Aussie Dollar Strengthens

Australian Pension Funds Boost Currency Hedging as Aussie Dollar Strengthens  Australian Household Spending Dips in December as RBA Tightens Policy

Australian Household Spending Dips in December as RBA Tightens Policy  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence

Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility