An improvement in news flow around China - on both economic growth and policymaking kick-started a rally in EM currencies last month. A substantially weaker-than-expected US jobs report which fueled speculation that the Fed would keep rates at a record low until next year gave further support. But the question remains "Does the EM rally have further to go?" given the ever darkening outlook over EM growth.

The EM rally is not built on great foundations. EM countries continue to face headwinds from weak global and intra-EM trade, low global commodity prices, high levels of total debt as well as idiosyncratic political uncertainties in a few areas. The International Monetary Fund also cut its global growth forecasts late on Tuesday and predicted the biggest hit to growth would come from emerging markets.

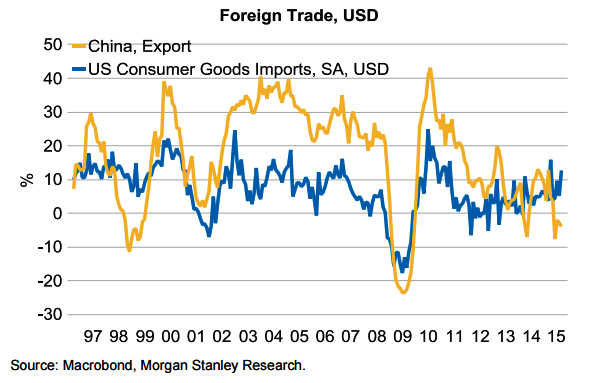

However, US trade data confirmed that strongly rising US imports benefited Asian exporters. The US trade detail shows that the US deficit with EM has continued to widen against most countries on a 12m/12m basis. This has occurred via both US imports from the EM world rising and US exports to EM in decline.

"To this end, we think USD strength weighing on US growth, with our economists seeing a 0.8pp reduction in US 3Q GDP from net exports, means FX trends are helping to rebalance global growth", says Morgan Stanley in a research note.

The figure above shows upcoming Chinese data releases are likely to come in on the strong side based on the relationship between US consumer goods imports and China's total export growth. Rising US imports could inspire currently stagnating global trade.

But if Asian economies fail to capitalize from rising U.S imports and incremental Chinese fiscal stimulus, then EM will enter its next leg lower. China's data stabilisation witnessed in September cleared the path for the current EM rally; as such, China related data will stay in focus for the day to day assessment on how far this rally may progress.

Emerging Market rally to go further?

Friday, October 16, 2015 12:12 PM UTC

Editor's Picks

- Market Data

Most Popular

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary