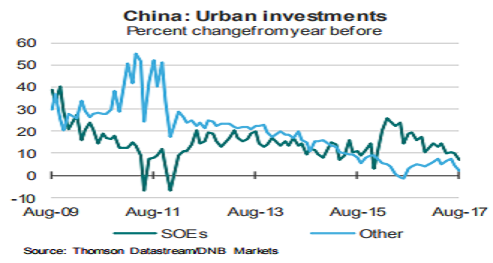

Economic growth in China is about to slow, due to less expansionary fiscal policy, a slowdown in real estate, and tighter credit conditions. On top of this, there are early signs that the government is tolerating slower economic growth to limit pollution. One large city has recently suspended investments to improve air quality.

Consequently, sales growth will be driven by private demand which is likely to fall in coming quarters, in line with what we have seen in large cities for some time already. If anything, this bodes for reduced home building and less demand for machinery tools, transport equipment, and raw materials. Moreover, with housing investments accounting for 13 percent of GDP, the highest since 2013, the impact on GDP growth will be significant.

On top of that, there are clear signs that the housing market has peaked. Sales in large cities are down 15 percent y/y so far in 2017. Smaller cities are doing better, but that is most likely temporary. Smaller cities have outperformed larger ones in part because of laxer home purchase restrictions, but more importantly because the government has emerged as an important home buyer.

Last year local authorities combined bought around 3 million empty homes from developers in an effort to balance the market, up from zero just two years before. The purchases are scheduled to continue until 2020, but the growth impact should more or less be out of the numbers by now.

"We are now seeing early signs that the government is willing to tolerate slower demand growth to improve the local environment," DNB Markets commented in its latest research report.

Meanwhile, FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data

Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions

Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions  Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations

Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations  Lee Seung-heon Signals Caution on Rate Hikes, Supports Higher Property Taxes to Cool Korea’s Housing Market

Lee Seung-heon Signals Caution on Rate Hikes, Supports Higher Property Taxes to Cool Korea’s Housing Market  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022