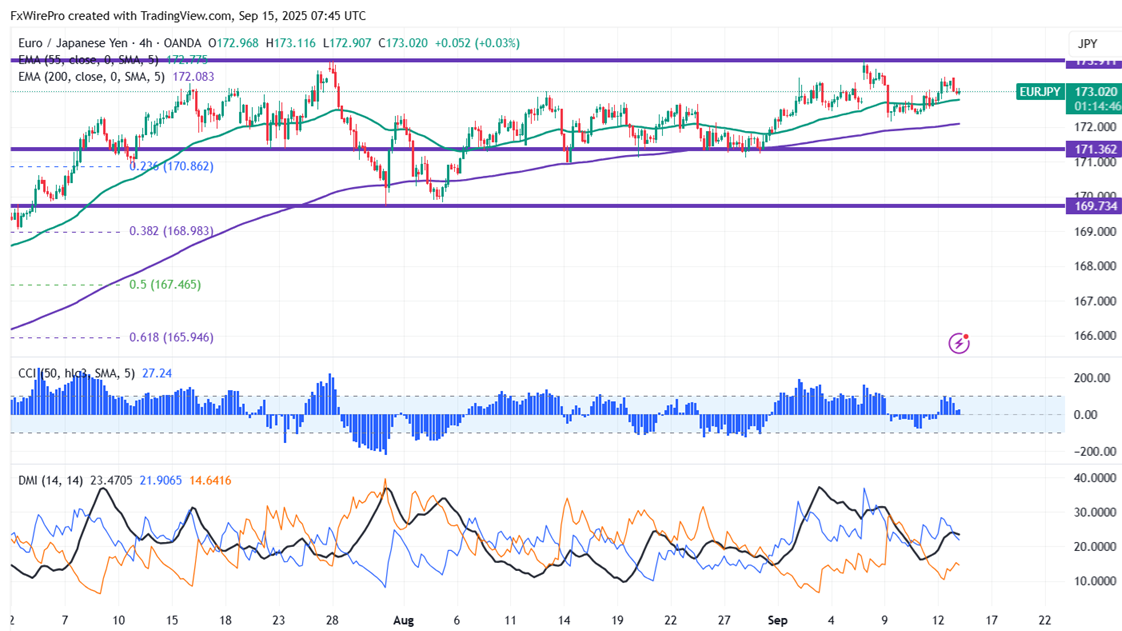

EURJPY has been consolidating in a narrow range between 173.91 and 172.14 for the past five days. It hit a high of 173.44 yesterday and is currently trading at approximately 173.08. Intraday outlook remains bullish as long as support at 172.50 holds.

Technical Analysis:

The EUR/JPY pair is trading above 55 EMA, above 200, and 365-H EMA on the 4-hour chart.

- Near-Term Resistance: Around 173.50, a breakout here could lead to targets at 173.90/175.

- Immediate Support: At 172.50 if breached, the pair could fall to 171.80/170.80/169.70/169/168.70/168.45/168.

Indicator Analysis 4-hour chart): - CCI (50): Bullish

- Average Directional Movement Index: Neutral

Overall, the indicators suggest a mixed trend

Trading Recommendation:

It is good to buy on dips around 172.68-70 with a stop loss at 172 for a TP of 175.

Z

NZDJPY Breaks 94: Bulls Charge as Kiwi Roars Back

NZDJPY Breaks 94: Bulls Charge as Kiwi Roars Back  FxWirePro- Major European Indices

FxWirePro- Major European Indices  FxWirePro: GBP/USD attracts selling interest, vulnerable to more downside

FxWirePro: GBP/USD attracts selling interest, vulnerable to more downside  FxWirePro: AUD/USD remains buoyant, looks to extend gains

FxWirePro: AUD/USD remains buoyant, looks to extend gains  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  FxWirePro: GBP/USD regains upwards momentum but unable to hold above 1.3700 level

FxWirePro: GBP/USD regains upwards momentum but unable to hold above 1.3700 level  EURJPY Breaks Above 184 – Euro Bulls Charge Toward 187

EURJPY Breaks Above 184 – Euro Bulls Charge Toward 187  FxWirePro: USD/ZAR dips below lower range, bearish bias increases

FxWirePro: USD/ZAR dips below lower range, bearish bias increases  AUDJPY Powers Above 109 – Yen Weakness Fuels Aussie Bulls

AUDJPY Powers Above 109 – Yen Weakness Fuels Aussie Bulls  FxWirePro- Woodies Pivot(Major)

FxWirePro- Woodies Pivot(Major)  FxWirePro: USD/CAD attracts selling interest, vulnerable to more downside

FxWirePro: USD/CAD attracts selling interest, vulnerable to more downside  EUR/GBP Slumps Under Pressure: Bearish Momentum Builds as 0.8675 Resistance Holds Firm

EUR/GBP Slumps Under Pressure: Bearish Momentum Builds as 0.8675 Resistance Holds Firm  FxWirePro: AUD/USD jumps after RBA rate hike

FxWirePro: AUD/USD jumps after RBA rate hike  FxWirePro: USD/CAD extends gains, eyes 1.3800 level

FxWirePro: USD/CAD extends gains, eyes 1.3800 level  GBPJPY Bulls Dominate: Holds Above 213 with Eyes on 215 Breakout

GBPJPY Bulls Dominate: Holds Above 213 with Eyes on 215 Breakout  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary