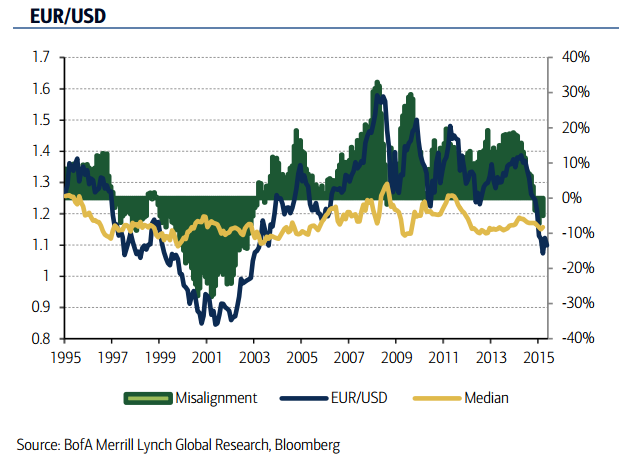

Surprisingly, EUR is close to its equilibrium level on a trade weighted basis, and EUR/USD is also close to fair value of 1.16. Indeed the equilibrium estimate for EUR/USD at 1.16 is below the long-term average level of the exchange rate of around 1.20, suggesting that equilibrium has shifted lower. In the short-to medium term, policy divergence will continue to be a powerful driver of EUR. The depreciation of the currency has so far been one of the most tangible benefits of QE. As such, it is expected that the ECB will act, continuing QE beyond September 2016, and signalling as much potentially as soon as next month, keeping pressure on EUR.

The Eurozone and the US are at different stages in the business cycle and the Fed will begin hiking rates, whether in September or soon after. This brings the short-term 'equilibrium' lower and forms the basis of the call for parity in EUR/USD by the end of 2015. In the longer-term however, the exchange rate will shift higher to reflect external equilibrium.

EUR also has scope to weaken vs both SEK and GBP for a number of reasons. On a pure valuation basis, SEK is more undervalued than EUR so we could see some correction there. In addition, while the Riksbank has been aggressive in its easing and has kept up with the ECB, it is believed that the ECB has more scope to ease for longer, implying gradual SEK strength vs EUR in the medium term. GBP itself is close to equilibrium. Nevertheless, for arguments similar to those mentioned for USD, monetary policy divergence between the ECB and the BOE implies EUR/GBP downside

EUR close to equilibrium but mind the ECB

Thursday, September 10, 2015 9:33 PM UTC

Editor's Picks

- Market Data

Most Popular

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence