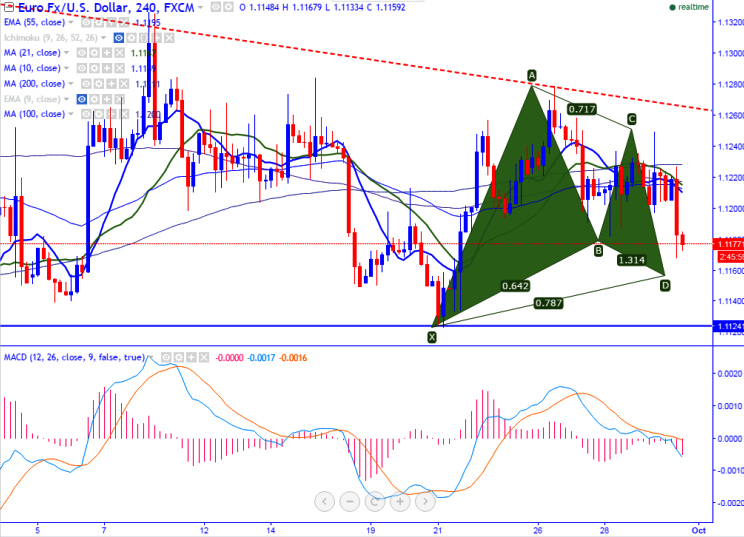

- Pattern Formed – Bullish Gartley pattern.

- Potential reversal Zone (PRZ) - 1.11570.

- The pair has retreated sharply after making a high of 1.12270 yesterday. It is currently trading around 1.11740.

- The pair breaks below 100- day MA at 1.11830 and declined slightly till 1.11680 at the time of writing. Any break below 1.1150 confirms further bearishness.

- The pair is facing strong resistance around 1.1280 (trend line joining 1.16163 and 1.13660)and any slight bullishness can be seen only above that level. The minor resistance is around 1.1210 (21- day MA)/1.1250.

- Short term weakness below 1.1120 level.

- On the lower side, major support is around 1.1150 (200- day MA) and any break below targets 1.1120/1.1045.

It is good to buy on dips around 1.1160 with SL around 1.1120 for the TP of 1.1245/1.1275.

Resistance

R1-1.1210

R2-1.1250

R3-1.1280

Support

S1-1.11570

S2-1.1120

S3-1.1045