High volatility in EUR-USD is observed in past few days.(6M ATMF volatility from approx. 11½% to just above 10%). Commerzbank argues that the preliminary end of the Greece crisis is a reason for moderately lower volatility.

The steepness of the volatility curve is something like a proxy for how extraordinary the market considers the current volatility level to be. And based on this comparison the EUR-USD options market is going through a period of relatively high structural volatility. Compared with the data since early August 2014 the volatility curve is relatively steep in relation to the current volatility level presented in above figure. That means the market "considers" the current volatility level to be unusually low. That does not suggest that volatilities will ease further, says Commerzbank.

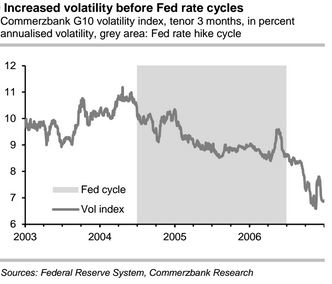

"Moreover FX volatilities are usually elevated before the start of the Fed rate hike cycle - as 2004 demonstrated. So until September at least we are likely to experience a hot rather than a lazy summer", according Commerzbank.

EUR-USD set for high volatility

Tuesday, July 21, 2015 7:47 AM UTC

Editor's Picks

- Market Data

Most Popular

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed