ECB’s ultra-expansionary monetary policy and improving global demand has improved the euro zone economic outlook recently. Overall strong data, released by the European Commission in Brussels and the Economy Ministry in Berlin earlier this month, suggested vibrant business activity in the euro zone at the turn of the year despite increased political uncertainties.

Nonetheless, inflation outlook remains too low. Rise in rate of inflation above 1 percent recently is mainly due to a move in energy prices. Economists doubt that the momentum will also be reflected in core inflation (excluding energy, food, alcohol and tobacco)as wage pressure is likely to remain low for some time due to the very high unemployment rates in the euro zone.

Consumer confidence has improved since August 2016 despite political turmoil regarding Brexit and Donald Trump's surprise victory and remains at a high level. Consumer confidence may thus still prove resilient even as Theresa May signals a 'Hard Brexit' and Trump lingers on specifying the economic plans for his administration. January’s Eurozone consumer confidence index is awaited later today and researchers at Danske Bank expect it to show a modest increase for January as the labour market still shows strength.

In the Euro area, a 1.1 percent y/y rise in consumer prices in December (aligned with a 1.7 percent y/y rise in Germany) is giving ammunition to ECB hawks. With above potential growth, falling unemployment, and higher headline and core inflation—the hawkish pressure is likely to build. The ECB confirmed this view at its January meeting. ECB President Mario Draghi pointed out repeatedly that the ECB was keen to ensure that the rise in inflation was “sustainable”.

The ECB had extended the programme until the end of 2017 in December. As the ECB reaches the upper limit of the purchasable bonds set by itself by early 2018, it will be forced to reduce the QE programme further. This results in an upside risk for the euro exchange rates. Moreover the political risks in the euro zone are likely to add pressure on the euro.

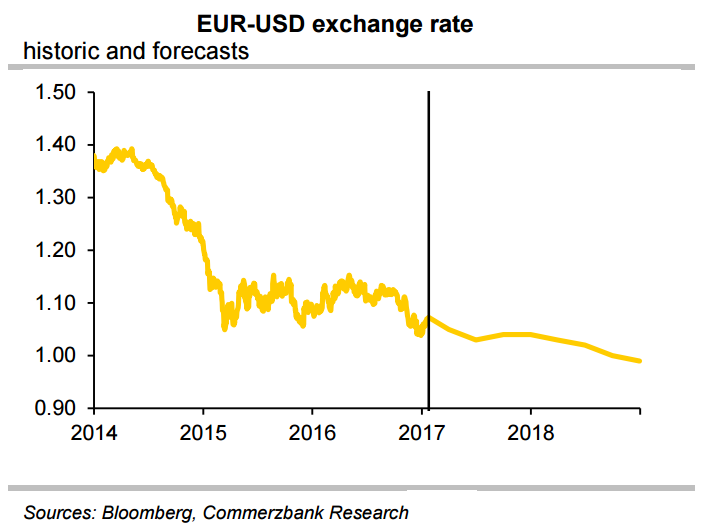

"Overall the risks in EUR-USD are well balanced short to medium term, so that we forecast a volatile sideways trade in EUR-USD. But as the ECB will have to principally remain expansionary even beyond 2017 while the Fed will continue to normalise monetary policy, we see a long term downtrend in EUR-USD." said Commerzbank in a report.

EUR/USD was trading at 1.0741 at 12:40 GMT, up 0.41 percent on the day. Technical studies are biased higher and we see scope for test of 100-DMA at 1.0831. FxWirePro's Hourly EUR Spot Index was at 28.0283 (Neutral) at 12:40 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand