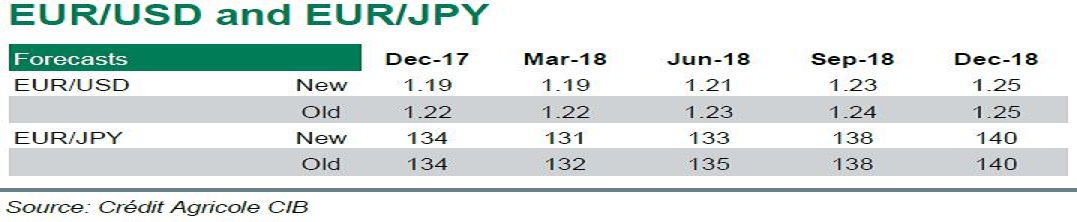

The EUR/USD currency pair is expected to gradually appreciate towards the 1.25-1.26 level by the end of 2018, according to a recent report by Credit Agricole CIB. That said, risks for the pair remain tilted to the upside over the medium to long-term. Indeed, with the ECB meeting out of the way, investors will now start to focus on the improving data coming out of the Eurozone.

On the USD-side, some positives from US President Donald Trump’s fiscal stimulus seem to be in the price. Coupled with the still dovish ECB forward guidance, this should keep the EUR-USD 2Y rate spread close to multi-year lows. At the same time, a gradual drift higher of EGB yields that are expected to be seen over the coming months should erode the attractiveness of UST investments for Eurozone investors.

In all, further unwinding of EUR-funded policy divergence trades is expected from now on. Combined with continuing inflows into the Eurozone equity markets, this should prop up EUR going forward.

"We continue to expect EUR/USD to appreciate gradually towards its long-term fair value of 1.25-1.26 by the end of 2018. Coupled with our relatively balanced outlook for USD/JPY, we also expect EUR/JPY to remain on an uptrend from now on, heading to 140 in Q418," the report said.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations

Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions

Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions  Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data

Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data  Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence

Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Asian Currencies Stay Rangebound as Yen Firms on Intervention Talk

Asian Currencies Stay Rangebound as Yen Firms on Intervention Talk  Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment

Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment