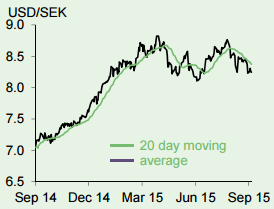

Despite ultra-loose monetary policy in Sweden, the krona has struggled to weaken past 9.70 against the euro this year. The possibility that the ECB could extend or add more stimulus, combined with the uncertainty around Fed policy, is likely to add pressure on the Riksbank to further ease policy. Headline inflation, at an annual -0.2% in August, is also well below the central bank target, and supports the need for more stimulus, notes Lloyds Bank.

Meanwhile, recent economic data have been mixed. However, that can be done to weaken the currency remains unclear. The central bank has already instituted a negative deposit rate and enacted a QE program.

"A modest depreciation against the euro is expected to the 9.39-9.45 range over the coming year. However, we largely rule out a return to the March high against the euro of 9.0547 given recent policy actions", states Lloyds Bank.

EUR/SEK outlook

Thursday, September 24, 2015 8:04 AM UTC

Editor's Picks

- Market Data

Most Popular

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed