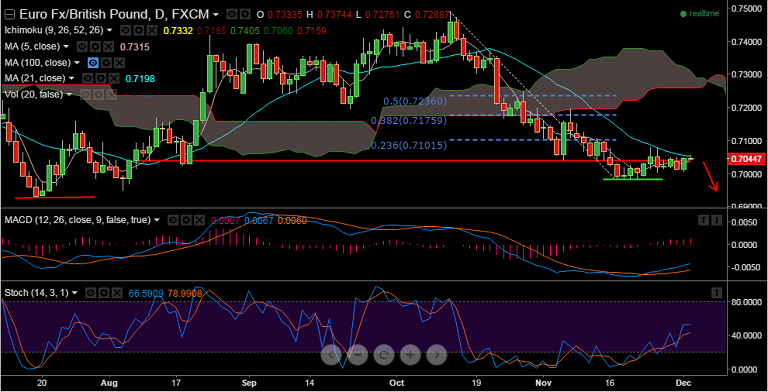

- EUR bears fought back control amid broad based US dollar strength pushing EUR/GBP to sessions lows at 0.7040 in early trade today

- Heading into the European Session, the pair broke key 21-DMA resistance which was capping gains in the pair Nov 24/25

- Spike was however short-lived, the pair has slipped back to 0.7048 levels, could see some further consolidation but bear bias remains intact

- Focus now shifts towards the UK construction PMI result which will be followed by Euro zone flash CPI for further momentum in the pair

- Immediate resistance is seen at 0.7080 (Daily High Nov 25) while supports on the downside are located at 0.7007 (Daily Low Dec 1)

R1: 0.7080 (Daily High Nov 25)

R2: 0.7089 (30 DMA)

R3: 0.7108 (Daily High Nov 12)

Support Levels:

S1: 0.7007 (Daily Low Dec 1)

S2: 0.7003 (Daily Low Nov 25)

S3: 0.6982 (Daily Low Nov 18)