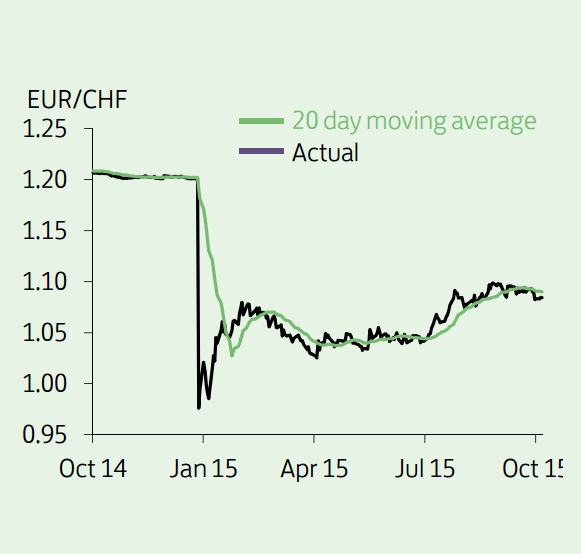

The increased probability of more QE from the ECB has lifted the euro marginal versus the franc to 1.07829 - its strongest level since early September. Further QE-related strength in the franc could pose a challenge for the Swiss central bank, which views the currency as being 30% overvalued and has already imposed a negative deposit rate of 0.75%.

There seems to be a general sense that if the euro falls below parity against the franc policy makers will intervene to weaken the exchange rate. In that context, the 10 December Swiss central bank meeting could prove pivotal in terms of the kind of policy response that can be expected in light of a potential move by the ECB.

"We hold the view that policy makers will do what is necessary to at least allow the euro to hold its tight range of 1.08-1.07 in the short term, before fundamentals prompt a push higher to 1.18", says Lloyds Bank.

After the surprise removal by the central bank of the floor against the euro back in January, however, there remains significant uncertainty around the central bank's reaction function. As such, the risks to the forecast are skewed equally in both directions.

EUR/CHF Outlook

Wednesday, October 21, 2015 11:45 PM UTC

Editor's Picks

- Market Data

Most Popular

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX