EM private sector balance sheet mismatches (ZAR, TRY and MYR), foreign positioning in local currency bonds (CEE, IDR, ZAR and MXN), a dependence on foreign financing (CEE) and the lack of foreign currency reserves (TRY, ZAR, IDR) are likely to amplify EM FX moves.

"EM vulnerabilities are likely to become a point of interest for markets once again. Spill-overs from China add to the underperformance of manufacturing- vs. services-driven economies and calls for fundamental weakening in EM FX relative to the USD", says Barclays.

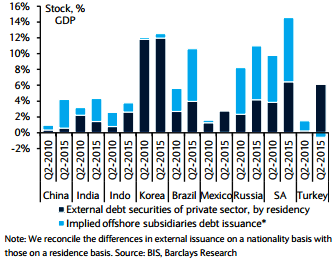

The Figure explains details on measures that compare EMs on their vulnerabilities.

EM vulnerabilities return as the USD rises

Friday, August 21, 2015 3:47 AM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022