The ECB policy settings are widely expected to remain unchanged in its January meeting and press conference (Thursday) this week. Its dovish rhetoric is expected to put a downward pressure on the currency.

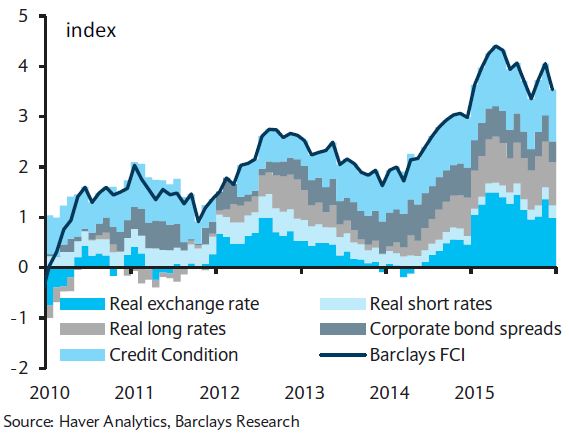

In the statement and press conference, the ECB is likely to show concern with the tightening in financial conditions that has occurred since its December meeting, including 5% EUR NEER appreciation. This dovish message is likely to be reiterated by President Draghi and Executive Board Member Coeuré when they speak at the World Economic Forum in Davos, Switzerland on Friday.

"With EA core inflation and market measures of inflation expectations remaining extremely low (the EA 5-year forward, 5-year breakeven inflation rate is about 1.6%, versus above 1.8% in early December, Figure 5), we continue to think longer or greater policy accommodation is likely, which should weigh heavily on the EUR," noted Barclays.

"We now expect euro area inflation to return to negative territory between Februaryand July 2016, picking up thereafter as a result of base effects, but averaging only 0.1% y/y for the year as a whole (vs. 1% in the ECB's December projections)."

ECB will likely be pressured to announce another round of monetary easing measures, but unlikely to be deployed before June, unless there is another bout of euro appreciation or a further significant drop in inflation expectations.

ECB's dovish stance should pressure Euro

Monday, January 18, 2016 12:49 AM UTC

Editor's Picks

- Market Data

Most Popular

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal