ECB meeting on 8th December will be largely influenced by developments in Italy's politics as we head into Italian referendum scheduled to take place on 4th December. At its semi-annual financial stability report last week, the ECB expressed concern regarding the possible unrest a 'No' vote could cause in the financial markets. ECB's Vice-President Vítor Constâncio underlined that the central bank would react to “shocks” caused by the Italian referendum.

Prime Minister Matteo Renzi has renewed pledge to resign if he loses the upcoming constitutional referendum. Opinion polls indicate a 4-5pp lead for the 'No' side, but polling uncertainty and a large share of undecided voters mean that the actual results can go either way.

A 'No' vote may not be a big surprise but is still likely to have a major impact on Italian politics, the banking sector and financial markets. The Italian government has been struggling to address weakness in the banking sector even before the referendum. A 'No' vote would weaken the government and make efforts even harder, while capital for the banks via the private sector would be even harder to find.

A 'Yes' vote on the other hand, will be a better start, but it will be hard to see any quick improvements in the Italian outlook. Markets are likely to retain a cautious view on Italian assets, at least until the political situation and foremost the outlook for the banking system clears.

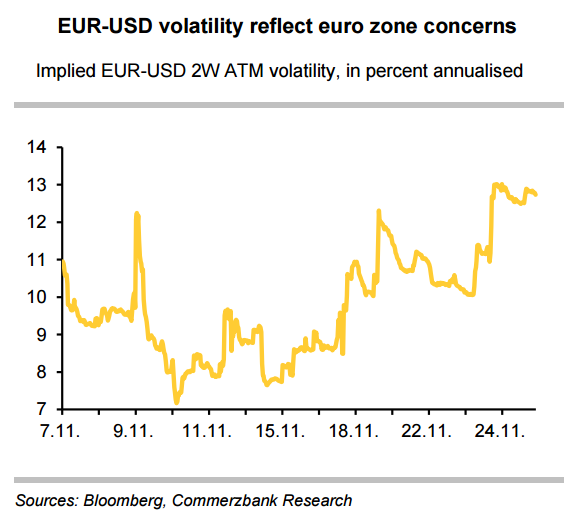

The implied EUR-USD volatility recently rose to the levels seen during the rather volatile US election night. Italian politics may become decisive for the ECB meeting on 8th December. ECB stands ready to temporarily step up purchases of Italian government bonds if referendum rocks market. The European Central Bank meets on Dec. 8 and is widely expected to extend its bond-buying program.

"We expect the ECB to announce an extension of its bonds purchasing programme beyond March 2017 at its last meeting of the year. This step is likely to become even more urgent if it has to stop a further rise of yields on Italian government bonds," said Commerzbank in a report.

EUR/USD was trading at 1.0640 at around 1215 GMT. FxWirePro's Hourly EUR Spot Index was at 58.6504 (Neutral) and Hourly USD Spot Index was at 25.7542 (Neutral) at 1215 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals