Barclays notes:

Since the ECB launched its asset purchase programme in March, the Governing Council has remained cautiously optimistic about its potential effect. Although President Draghi highlighted a slight loss of momentum in the euro area economy at the June GC meeting, due to modest weakening in international trade, there were no significant revisions to the staff forecasts, which include the full impact of the asset purchase programme and of all other unconventional policies deployed since June 2014. Our financial conditions index suggests that despite a slight tightening since April due to the bond market selloff and a renewed euro appreciation, financial conditions remain very accommodative from a historical standpoint and should continue to support economic activity.

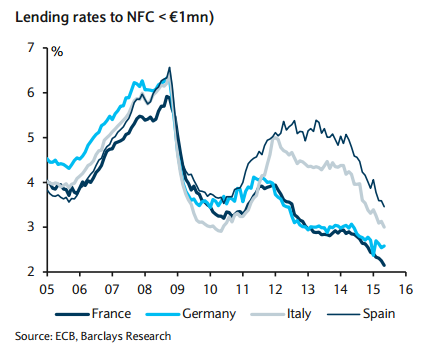

Our new QE monitor shows that monetary policy is gradually working its way through the economy, with ECB balance-sheet and market-based indicators mostly in the "green". Lending rates to the real economy have continued to decline and converge across countries, while credit standards have eased further during the second quarter of 2015, although banks do not foresee further easing ahead. However, macroeconomic indicators are still lagging as the transmission to the real economy takes time. Despite the large market correction since April, financial conditions are still very supportive.

As expected, the GC decided to leave its monetary policy unchanged at its July monetary policy meeting and restated its commitment to continue its asset purchase programme at least until September 2016, and until we see a sustained adjustment in inflation consistent price stability, ie, the medium-term outlook below, but close to, 2%. President Draghi noted that the GC was closely monitoring developments in financial markets. He said that recent market uncertainties had not changed the economic outlook for now. Should the situation change, particularly in financial markets, and threaten the accommodative stance of monetary policy due to unwarranted tightening and price stability, the GC stands ready to act and use all available tools in its mandate. This echoes statements made by other board members during the past few weeks that further monetary support would not be ruled out if the outlook deteriorates.

Our view is that the ECB will indeed continue its monthly asset purchases at the same pace until September 2016, and probably even longer, given we believe the increase in inflation will likely be slower than the ECB currently projects. Moreover, we believe there is a nonnegligible chance that additional QE measures could be announced by the end of this year depending on financial market developments, especially in conjunction with upcoming discussions about the third Greek bailout.

ECB monetary policy on hold with an easing bias

Wednesday, July 22, 2015 9:48 PM UTC

Editor's Picks

- Market Data

Most Popular

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022