European Central Bank (ECB) holds monetary policy meeting on 9th this week and we expect no changes to main rates or QE program. The ECB will also publish new growth and inflation projections. The ECB has maintained an ultra-loose monetary policy to stimulate growth in the eurozone and avoid deflation. In December, the ECB said it would extend its bond-buying programme until at least December 2017, although the €80bn-a-month quantitative easing (QE) scheme will be trimmed to €60bn a month from April.

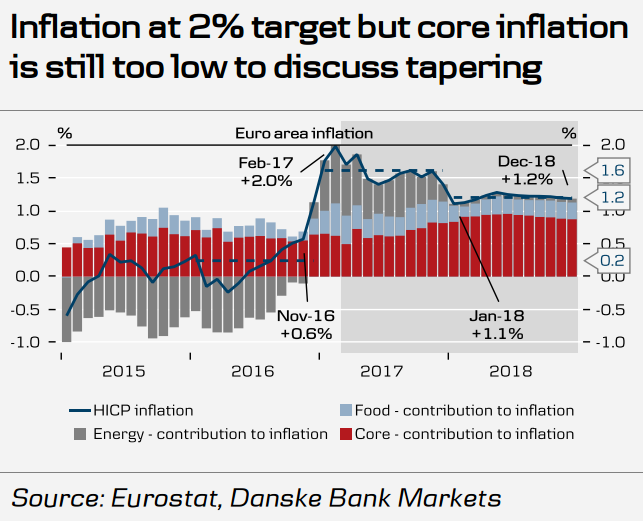

Eurozone inflation has risen above the ECB's target rate for the first time in four years, data from statistical agency Eurostat showed last week. Inflation in the 19-nation bloc hit 2 percent in February, up from a rate of 1.8 percent the month before. February's core inflation rate - which strips out the impact of energy and food prices - was unchanged at 0.9 percent.

The ECB has clearly communicated in the introductory statement from the latest meeting that ‘the Governing Council will continue to look through changes in HICP inflation if judged to be transient and to have no implication for the medium-term outlook for price stability’. Since the stronger inflation figure in February was largely driven by the volatile energy and unprocessed food price inflation, and whereas the underlying price pressure remained weak, we do not expect the ECB to alter its current stimulus programme.

That said, economic data has been improving steadily in recent weeks. The Euro-Zone Citi Economic Surprise Index finished last week at +70.0, up from +55.9 in the prior month. On the other hand, despite the German and Euro-Zone CPIs running through +2 percent, the 5-year, 5-year inflation swap forwards, ECB's favourite measure, have slipped back the past month, finishing at 1.705 percent at the end of last week from 1.774 percent four-weeks ago.

Investors will focus on comments by ECB President Mario Draghi. Draghi is likely to balance out his optimism over near-term economic data against longer-term concerns amidst unfolding political uncertainty. It seems likely that he’ll downplay the ECB’s faith that inflation is returning in a meaningful way as there are still no signs of underlying price pressure, which will be highly dependent on a pick-up in wage pressure.

"We expect the ECB to maintain its dovish stance at the meeting this week although inflation has reached the 2% target. We still believe the ECB will extend its QE purchases beyond December 2017," said Danske Bank in a report.

EUR/USD was 0.39 percent down on the day at 1.0579 at around 1215 GMT. Meanwhile, FxWirePro's Hourly Euro Strength Index remained neutral at 41.9771 (a reading above +75 indicates a bullish trend, while that below -75 a bearish trend). For more details, visit http://www.fxwirepro.com/currencyindex.

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices