In a report published on Monday, the European Central Bank (ECB) has urged European Commission and leaders to fine Eurozone governments who have failed to pursue key economic reforms. ECB warned that a lack of progress over economic reforms hurts long-term growth and stability in the region. According to the central bank’s recommendation, the governments should be fined up to 0.1 percent of their respective gross domestic products (GDP). The measure is part of a new risk-monitoring system known as the macroeconomic imbalances procedure which was designed to prevent worrisome economic developments such as high current account deficits, unsustainable debt levels, and house-price bubbles.

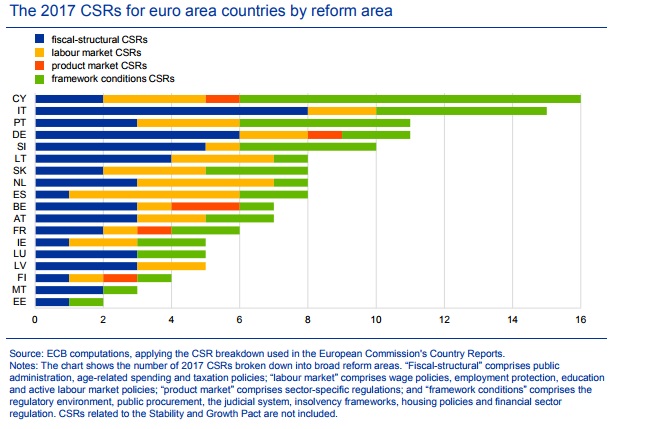

The EU’s executive arm, the European Commission said that the number of countries in which EU authorities have identified excessive imbalances is at an all-time high. France, Croatia, Italy, Cyprus, Portugal, and Bulgaria, are among those countries. According to a report released by the EU commission suggests that 90 percent of the recommended reforms in 2016 have seen limited or no progress at all. Every year the European Commission issues country-specific recommendations (CSRs) for each EU Member State, which contain the policy priorities for the following year. These recommendations are approved by the EU Council following endorsement by the Heads of State or Government of all EU Member States. The CSRs provide guidance tailored to the individual Member States on how to enhance growth and resilience while maintaining sound public finances.

Despite the recommendations from the ECB, the commission may be reluctant to push for large fines as they might contribute to the current social threat to the existence of the EU as well as the Eurozone. Here is the link to the full ECB report, http://www.ecb.europa.eu/pub/pdf/other/ebbox201705_05.en.pdf?375c1c0f99759e4fa05734bee73f2247

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January