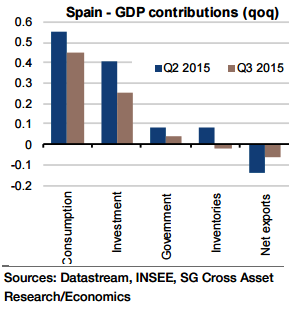

After growing by close to 1% per quarter on average in H1, a still-solid but slower Spanish economic environment is likely in Q3 (+0.7% qoq). Domestic demand is expected to have remained the main growth driver, supported by the low inflation environment, job creations, tax cuts and easing financial conditions.

In particular, the further improvement in the labour market (the unemployment rate declined to 21.2% - its lowest since 2011) and signs of a housing market revival had helped consumption with probably a further decline in the savings ratio.

Investment is likely to have decelerated noticeably in Q3 on the back of domestic political uncertainty but also external demand concerns. The contribution from net exports is expected to have remained broadly neutral.

"Looking towards 2016, GDP growth is expected to slow further, at 2% on average in 2016 vs 3% in 2015. Indeed, firstly, given the still-high levels of private sector debt, recent strength in consumption and investment appears unsustainable", says Societe Generale.

Secondly, the pick-up in inflation will weigh on real disposable income and hence on consumer spending. Finally, political uncertainties risk being a drag on businesses' investment and hiring decisions.

Domestic demand main driver for solid Spain GDP

Friday, October 30, 2015 6:36 AM UTC

Editor's Picks

- Market Data

Most Popular

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX