Trade surplus in excess of USD 1bn used to prompt cheers in the markets but this was not the case for July's USD 1.3bn. Perhaps markets are no longer concerned about the current account (C/A) deficit, which has indeed narrowed to a sustainable 2% of GDP in 1H15. More importantly though, markets seem to have fully understood that poor import growth (and not strong export growth) has been driving Indonesia's trade surplus so far this year.

The holiday distortions mean that we can't just single out the July trade data. Still, for the year-to-date, imports are down by close to 20%. It is not simply due to currency valuation as the rupiah has lost about 10% of its value against the dollars. Slower underlying demand must have explained the other 10%-pt fall in imports this year.

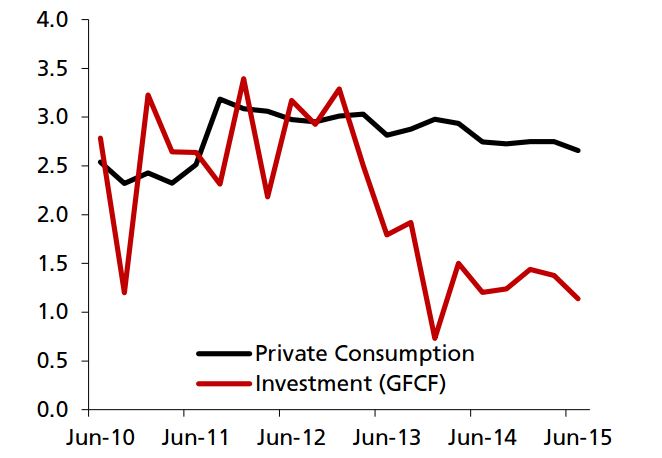

Investment growth is the biggest drag to overall GDP growth this year. A lot has been said about the moderation in consumption but consumption growth is still trending a decent 5%. It is investment growth that has been disappointing in 1H15 and the government was partly to blame. Up until mid-July, disbursement of capital expenditure was only about 15% of the full-year's target. Given the poor sentiment in the private sector, the economy needs this acceleration in public investment to provide the much-needed support.

Until there are signs that export growth has turned the corner, a wider trade surplus may only mean a further slump in domestic demand. And this is a worrying sign at a time when there are plenty of downside risks to GDP growth.

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient