Bitcoin has been spiking higher from the last couple of weeks, rose from the lows of $3,405.30 levels to the recent highs of $9,096 after surpassing various resistance levels.

Technically, after BTCUSD has bottomed out at $3,215.20 levels, consequently, the bullish engulfing pattern has occurred at $4,071.70 levels.

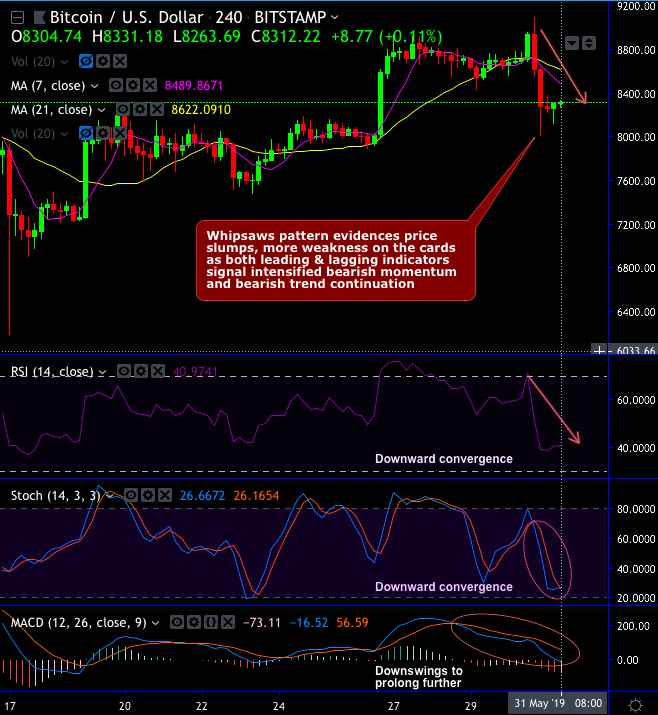

Whipsaws pattern in the minor trend, evidences price slumps, for now, more weakness seems to be on the cards as both leading & lagging indicators signal intensified bearish momentum and bearish trend continuation (refer 4H chart).

On the contrary, weekly analysis indicates bulls, at this juncture, seem to be shrugging-off whipsaw pattern that has occurred in the 4H chart.

While a series of fundamental news pertaining to crypto-space has been engulfing public consumption, the viability and vibrancy that public blockchains have recently provided documents from the U.S. Securities and Exchange Commission (SEC), wherein it says about a closed-door meeting.

VanEck claims that their Bitcoin ETF related issues have been resolved.

The SEC and quite a few representatives from CBOE Global Markets, VanEck, and SolidX summoned for detailed discussions regarding Bitcoin exchange-traded funds (ETFs). The US financial regulator came up with a memorandum of the event a fortnight to clarify public with some insight on this closed-door meeting.

As a result, bitcoin aspirants are looking quite optimistic about their ETF decision and hence, some constructive price behavior in the underlying asset.

Consequently, the pair is currently, trading at $8,250 levels which is almost more than 103% so far (from its recent lows of $3,122) in 4-5 months.

Technically, BTCUSD kept spiking higher constantly with intensified buying momentum ever since then the occurrence of engulfing patterns as you could make out from the weekly plotting, it has now gone above 21-EMAs.

Thereby, the pair hits the psychological highs of $9,096 mark. Followed by, the majority of the crypto fraternity experienced the middling performance with a few select altcoin markets surging strongly.

To substantiate this bullish sentiment, all technical indicators are in line with the price upswings.

Both RSI and Stochastic curves show upward convergence to the prevailing rallies that indicate the intensified buying momentum.

While lagging indicators (MACD on daily and monthly terms) show bullish crossovers, that also signals uptrend to prolong further in the weeks to come.

Currency strength index: FxWirePro's hourly BTC spot index is inching towards -67 levels (which is bearish), while hourly USD spot index was at 60 (bullish) while articulating (at 11:02 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?