Trend for USD/SGD seems to be reversed and attempting to evidence a gap up opening.

The oscillating indicators RSI (14) signals upward strength as both RSI curve and price line evidence rising convergence.

Slow stochastic is also signifying the oversold pressure as %K line crossover below 20 levels.

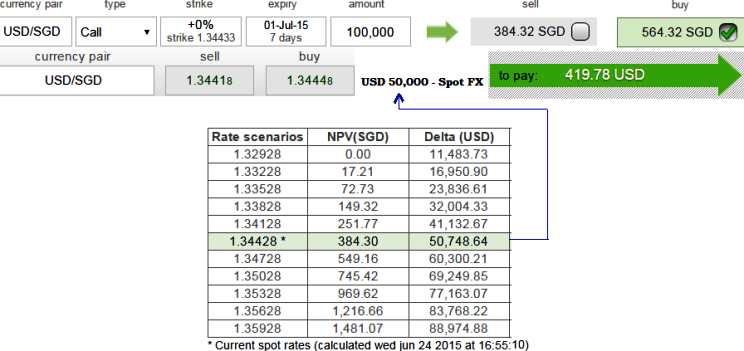

Since we anticipate the uptrend in this pair, the At-The-Money delta call of USD/SGD value indicates the option's equivalent position in the underlying market.

ATM calls might be luring for many speculators or hedgers at this moment.

Let's suppose for instance, as shown in the diagram USD/SGD ATM call option with Delta +0.5 can be delta hedged by shorting 50,000 USD against SGD in the underlying FX market.

Delta hedging of USD/SGD ATM calls on trend reversal

Wednesday, June 24, 2015 11:47 AM UTC

Editor's Picks

- Market Data

Most Popular

2

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate