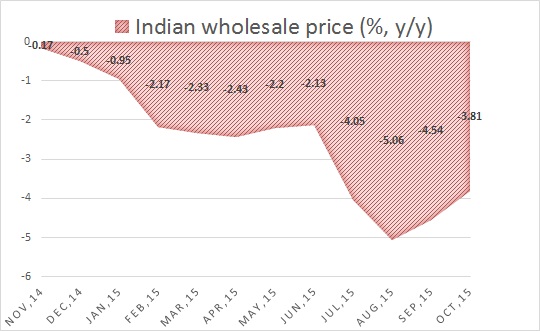

India's wholesale price index (WPI), one of the key measure of inflation in India, completed its first anniversary of deflation.

Thanks to lower oil price, after years of inflation prices have been dropping past one year providing ample room to Reserve Bank of India, which has reduced rates by 125 basis points to 675 basis points. After last move of front loading, in which RBI reduced rates by 50 basis points from 7.25%, it is unlikely that RBI would reduce rates further this year. Instead, RBI governor, Raghuram Rajan might prefer to wait for the move from both European Central Bank and US Federal Reserve in December.

- WPI, after declining -0.17% in last November, deflation gathered pace and prices drop reached peak in August, when prices dropped by -5.06%, after that prices declined by -4.54% in September and -3.81% in October, in line with popular expectation of -3.8% drop.

- Food price contributed big impact, which was up only by 2.44% y/y in October, compared to 0.69% in September. Fuel price index was down -16.32% y/y, compared to -17.71% in September. Manufacturing inflation down -1.67% y/y compared to -1.73% I September.

Despite yearlong drop in prices, economists believe it has more to do with oil than actual demand and reforms. India need to pursue to reforms to break supply bottle-necks or face higher inflation again, when oil price would move up.

Indian Rupee is firmer on the news trading at 66.05 per Dollar, down 20 pips.

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?