Decentraland is a virtual reality platform powered by the Ethereum blockchain. Users can create, experience, and monetize content and applications. It is not controlled by a centralized organization.

Decentraland protocol is composed of three layers

Consensus layer- It helps to track land ownership and its content. It will use an ETH smart contract to maintain a ledger of ownership for non-fungible digital assets called LAND.

Land content layer - Their main use is to download assets using a decentralized distribution system.

Real-time layer - this layer helps to interact between users.

Land ownership is established at the consensus layer, where land content is referenced through a hash of the file's content.

Key compenent of Decentraland -

LAND- Land is a non-fungible, transferable, scarce digital asset stored in an Ethereum smart contract. It can be bought by burning fungible ERC 20 tokens called MANA.

LAND Parcel- It is a non-fungible (NFT, ERC 721), which cannot be forged or duplicated. It can be bought and sold on the marketplace.

Estate- Two or more adjacent LAND parcels form an estate. This can also be bought and sold on the marketplace.

Avatars- The digital representations of actual people in the virtual world.

Builder Tools are only available on desktops which helps to create 3D content within decentraland.

Total LAND- 90601 (43689 private land parcels, 33886 district LAND, 9438 roads, 3588 plazas)

Each LAND size- 16m*16m square spaces.

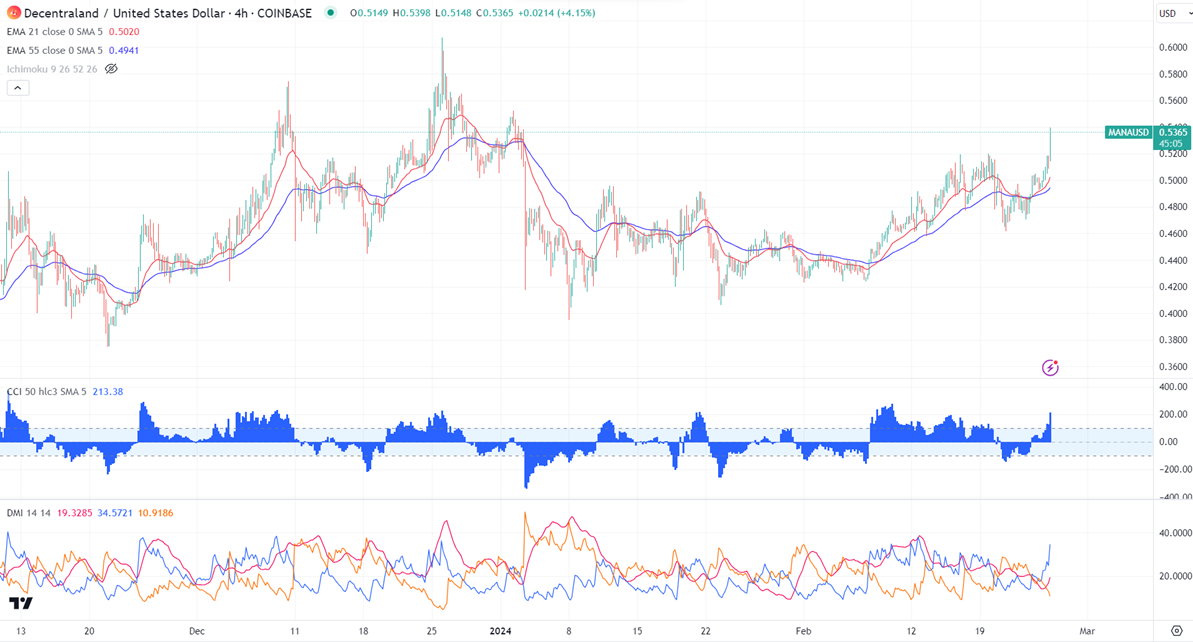

MANAUSD surged more than 15% in the past five days. The pair holds above the short-term (21 and 55 EMA) and above the long-term moving average. It hit a high of $0.5398 and is currently trading around $0.5373.

The bullish invalidation can happen if the pair closes below $0.2600. On the lower side, the near-term support is $0.50. Any break below targets $0.455/$0.390. Significant downtrend if it breaks $0.260.

The pair's near-term resistance is around $0.610. Any breach above confirms minor bullishness. A jump to $0.80/$1 is possible. A surge past $1.20 will take it to $2.

It is good to buy on dips around $0.450 with SL around $0.260 for TP of $1/$1.20.

Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge