In August the Danish central bank bought Danish kroner for DKK 48.1 in the currency market to counter a weakening of the krone against the euro. Historically, it appears to be a very large amount, and it is the highest amount that the central bank has spent on intervention since it embarked on the normalisation of Danish monetary policy in early April.

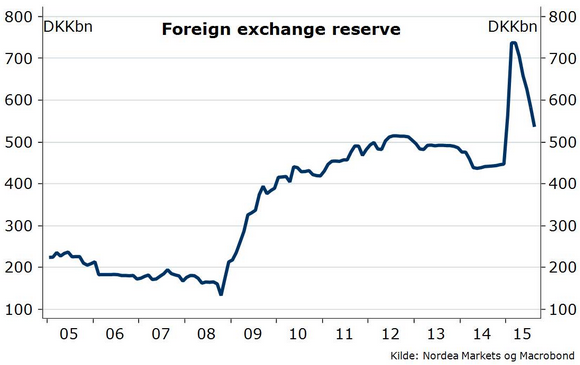

With the purchases in August, the central bank has intervened in the market for a total amount of DKK 190bn since the beginning of April. With the past few months' buying of Danish kroner the currency reserve has declined to DKK 536bn at present, from a historical high of more than DKK 737bn in March, notes Nordea Bank.

Last week the central bank announced that it planned to resume issuance of Danish government bonds in early October. This means that if the depreciation pressure on the Danish krone continues, the next natural step for the central bank would be a unilateral rate hike.The central bank will make this move towards year-end.

"In the years ahead the central bank is likely to continue narrowing the interest rate differential versus the ECB. By end-2017, the Danish CD rate is likely to be on a par with the ECB's deposit rate, ie at -0.20%", foresees Nordea Bank.

Danish central bank may hike rate to curbe kroner depreciation

Thursday, September 3, 2015 6:21 AM UTC

Editor's Picks

- Market Data

Most Popular

5