BofA Merrill Lynch notes:

Seasonal patterns are usually best left to the numbers without second guessing with macro rationale. Nevertheless, there are two reasons why we think the impact could be exaggerated this year and one taking away from it.

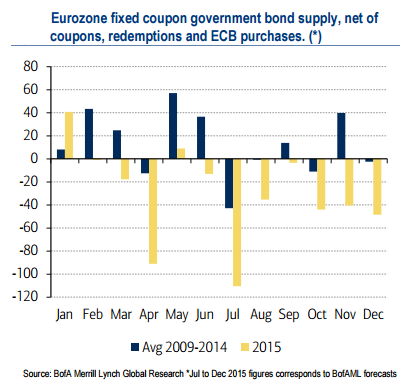

- First, the net supply arguments in Europe are starker given the presence of a price insensitive buyer (ECB) this year. As we have established before, the causality between Bunds and USTs have flipped, which makes European moves more critical for global yields.

- Second, liquidity conditions on either side of the Atlantic are worse than they have been recently, exaggerating any flow impact.

- A risk factor, however, could be the impact of high corporate supply. Corporate supply in the US has had a much more noticeable impact on outright level of rates this year. And with our corporate strategists expecting a continued heavy issuance calendar both in the US and Europe, this poses the biggest risk to our tactical bullish stance.

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX