Dollar index trading at 95.01 (-0.80%).

Strength meter (today so far) - Euro +1.16%, Franc +1.23%, Yen +1.2%, GBP +0.08%

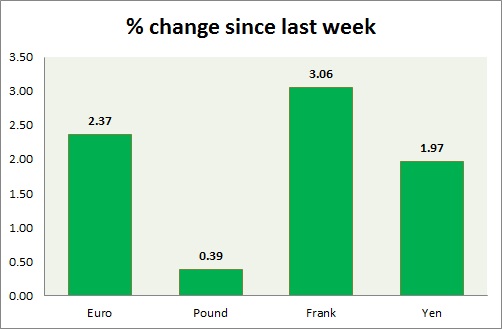

Strength meter (since last week) - Euro +2.37%, Franc 3.06%, Yen +1.97%, GBP +0.39%

EUR/USD -

Trading at 1.136

Trend meter -

- Long term - Sell, Medium term - Range, Short term - Range

Support

- Long term - 1.048-1.036, Medium term - 1.065-1.06, Short term - 1.08-1.085

Resistance -

- Long term - 1.175-1.18, Medium term - 1.155-1.16, Short term - 1.14-1.145, Immediate - 1.125-1.132(broken)

Economic release today -

- Euro zone manufacturing PMI remained flat at 52.4 in August, while services PMI rose to 54.3 compared to 54 prior as per flash estimate

Commentary -

- Euro sharply higher this week, likely to challenge 1.145 resistance area.

GBP/USD -

Trading at 1.57

Trend meter -

- Long term - Buy, Medium term - Range, Short term - Range

Support -

- Long term - 1.425-1.417, Medium term - 1.497-1.49, Short term - 1.518-1.512, Immediate - 1.544-1.54

Resistance -

- Long term - 1.592-1.616, Medium term - 1.595, Short term - 1.572

Economic release today -

- Public sector net borrowing came at -£2.07 billion in July.

Commentary -

- Pound is continuing its range in spite of weakness in Dollar. Active call - Buy Pound against Dollar, targeting 1.595 area and 1.609 area with stop loss around 1.54 and 1.53 area.

USD/JPY -

Trading at 121.9

Trend meter -

- Long term - Buy, Medium term - Range/Buy, Short term - Range/Buy

Support -

- Long term - 113.7-112.9, Medium term - 115.7-115, Short term - 119.7, Immediate - 120.7

Resistance -

- Long term - 130, Medium term - 127.5, Short term - 127.5.

Economic release today -

- Japanese PMI set to rise to 51.9 in August.

Commentary -

- Yen is sharply up today, driven by risk aversion sentiment.

USD/CHF -

Trading at 0.946

Trend meter -

- Long term - Buy, Medium term - Range, Short term - Range/Sell

Support -

- Long term - 0.88, Medium term - 0.90, Short term - 0.95(broken)

Resistance -

- Long term - 1.174, Medium term - 1.025-1.02, Short term - 0.984-0.987

Economic release today -

- NIL

Commentary -

- Franc is the best performer this week, driven by weak dollar and haven buying. Active call - Sell Dollar against Franc targeting 0.93 area, with stop around 0.98 area.