Dollar index trading at 96.42 (-0.05%)

Strength meter (today so far) – Euro -0.08%, Franc -0.13%, Yen +0.11%, GBP +0.11%

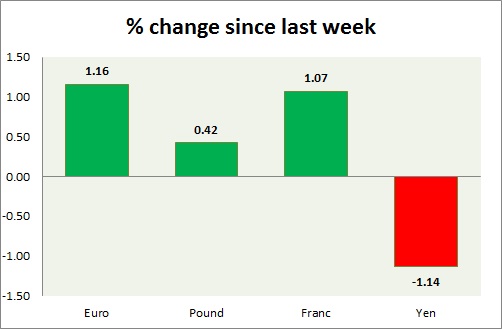

Strength meter (since last week) – Euro +1.16%, Franc +1.07%, Yen -1.14%, GBP +0.42%

EUR/USD –

Trading at 1.132

Trend meter –

- Long term – Sell, Medium term – Buy, Short term – Range/ Buy

Support

- Long term – 1.05, Medium term – 1.08, Short term – 1.11

Resistance –

- Long term – 1.16, Medium term – 1.143, Short term – 1.13 (broken)

Economic release today –

- Private loans grew 2.4 percent y/y in May.

- M3 money supply grew 5.1 percent in 3 months to May.

- ECB President Draghi is scheduled to speak at 13:30 GMT.

Commentary –

- The euro remains upbeat on hawkish comments from ECB President Mario Draghi.

GBP/USD –

Trading at 1.283

Trend meter –

- Long term – Sell, Medium term – Buy, Short term – Sell

Support –

- Long term – 1.21, Medium term – 1.24, Short term – 1.263

Resistance –

- Long term – 1.345, Medium term – 1.305, Short term – 1.283

Economic release today –

- BoE’s Carney is scheduled to speak at 13:30 GMT.

Commentary –

- The pound is up this week on a weaker dollar. We expect the pound to reach parity in the longer run.

USD/JPY –

Trading at 112.1

Trend meter –

- Long term – Sell, Medium term – sell, Short term – Range/Sell

Support –

- Long term – 107, Medium term – 108.4, Short term – 109

Resistance –

- Long term – 116, Medium term – 114.2, Short term – 111.6 (broken)

Economic release today –

- Retail trade report for May will be published at 23:50 GMT.

Commentary –

- The yen is the worst performer of the week.

USD/CHF –

Trading at 0.962

Trend meter –

- Long term – Buy, Medium term – Range/Buy, Short term – Range/Sell

Support –

- Long term – 0.90, Medium term – 0.92, Short term – 0.95

Resistance –

- Long term – 1.04, Medium term – 1.01, Short term – 0.987

Economic release today –

- UBS consumption indicator improved to 1.39 in May.

- Zew survey expectations declined to 20.7 in June.

Commentary –

- Franc is up in line with the euro this week.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX