Dollar index trading at 96.6 (+0.33%).

Strength meter (today so far) - Euro -0.23%, Franc -0.05%, Yen -0.10%, GBP -0.15%

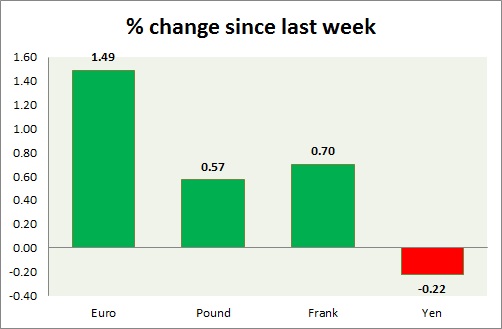

Strength meter (since last week) - Euro +1.49%, Franc +0.70%, Yen -0.22%, GBP +0.57%

EUR/USD -

Trading at 1.113

Trend meter -

- Long term - Sell, Medium term - Range, Short term - Range/ Buy

Support

- Long term - 1.048-1.036, Medium term - 1.065-1.06, Short term - 1.08-1.085

Resistance -

- Long term - 1.175-1.18, Medium term - 1.155-1.16, Short term - 1.14-1.145, Immediate - 1.125-1.132

Economic release today -

- NIL

Commentary -

- Euro is the best performer this week, today is reeling in correction as Dollar gained ground. Euro is likely to rise further.

GBP/USD -

Trading at 1.558

Trend meter -

- Long term - Buy, Medium term - Range, Short term - Range

Support -

- Long term - 1.425-1.417, Medium term - 1.497-1.49, Short term - 1.518-1.512, Immediate - 1.544-1.54

Resistance -

- Long term - 1.592-1.616, Medium term - 1.595, Short term - 1.572

Economic release today -

- NIL

Commentary -

- Pound is dropping from around range high and continuing consolidation.

USD/JPY -

Trading at 124.4

Trend meter -

- Long term - Buy, Medium term - Range/Buy, Short term - Range/Buy

Support -

- Long term - 113.7-112.9, Medium term - 115.7-115, Short term - 119.7, Immediate - 120.7

Resistance -

- Long term - 130, Medium term - 127.5, Short term - 127.5.

Economic release today -

- NIL

Commentary -

- Yen remains the worst performer this week so far. However Yen is gaining some safe haven bids. Yen might lose to 127 against dollar if support around 121 holds.

USD/CHF -

Trading at 0.976

Trend meter -

- Long term - Buy, Medium term - Range, Short term - Range

Support -

- Long term - 0.88, Medium term - 0.90, Short term - 0.95

Resistance -

- Long term - 1.174, Medium term - 1.025-1.02, Short term - 0.984-0.987

Economic release today -

- Producer price index dropped -6.4% in July from a year ago.

Commentary -

- Franc is the best performer this week, over heavy profit booking at key level. USD/CHF has reached our target of 0.987 area.

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand