Dollar index trading at 96.93 (+0.45%)

Strength meter (today so far) – Euro -0.55%, Franc -0.52%, Yen +0.04%, GBP -0.06%

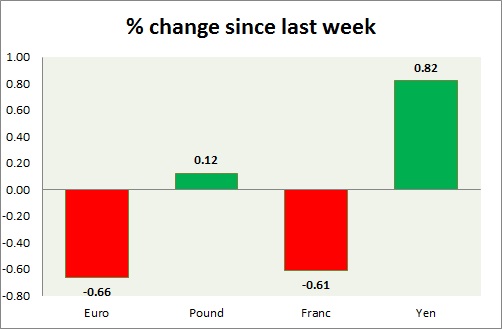

Strength meter (since last week) – Euro -0.66%, Franc -0.61%, Yen +0.82%, GBP +0.12%

EUR/USD –

Trading at 1.121

Trend meter –

- Long term – Sell, Medium term – Buy, Short term – Range/ Buy

Support

- Long term – 1.07, Medium term – 1.09, Short term – 1.10

Resistance –

- Long term – 1.16, Medium term – 1.14, Short term – 1.14

Economic release today –

- NIL

Commentary –

- The euro became the worst performer of the day and week.

GBP/USD –

Trading at 1.29

Trend meter –

- Long term – Sell, Medium term – Buy, Short term – Buy

Support –

- Long term – 1.16, Medium term – 1.23, Short term – 1.27

Resistance –

- Long term – 1.32, Medium term – 1.305, Short term – 1.305

Economic release today –

- Halifax House price index grew 0.4 percent in May, up 3.3 percent from a year ago.

- RICS house price balance report will be released at 23:00 GMT.

Commentary –

- The pound is likely to remain range bound heading into the election this week. We expect the pound to reach parity in the longer run.

USD/JPY –

Trading at 109.4

Trend meter –

- Long term – Sell, Medium term – sell, Short term – Range

Support –

- Long term – 107, Medium term – 109, Short term – 110 (broken)

Resistance –

- Long term – 119, Medium term – 115, Short term – 113

Economic release today –

- Coincident index improves to 117.7 while leading economic index declines to 104.5

- 1st quarter GDP numbers will be released at 23:50 GMT, along with trade balance report for April.

Commentary –

- The yen is the best performer of the week on geopolitical tensions.

USD/CHF –

Trading at 0.967

Trend meter –

- Long term – Buy, Medium term – Range/Buy, Short term – Range

Support –

- Long term – 0.92, Medium term – 0.95, Short term – 0.95

Resistance –

- Long term – 1.04, Medium term – 1.01, Short term – 0.98

Economic release today –

- Forex reserve marginally declines to 694 billion in May.

Commentary –

- Franc is down in line with the euro. It is heading for a test of 0.95 area.

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX