Dollar index trading at 97.23 (+0.07%)

Strength meter (today so far) – Euro +0.01%, Franc +0.04%, Yen -0.08%, GBP -0.23%

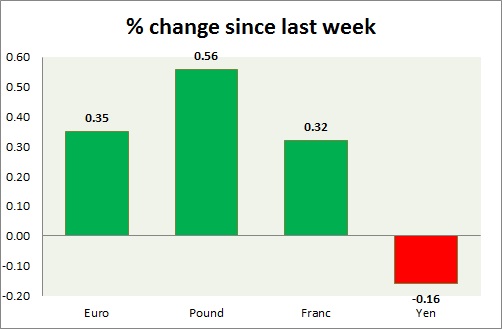

Strength meter (since last week) – Euro +0.35%, Franc +0.32%, Yen -0.16%, GBP +0.56%

EUR/USD –

Trading at 1.122

Trend meter –

- Long term – Sell, Medium term – Buy, Short term – Range/ Buy

Support

- Long term – 1.07, Medium term – 1.09, Short term – 1.10

Resistance –

- Long term – 1.16, Medium term – 1.14, Short term – 1.12 (testing)

Economic release today –

- Producer price inflation flat for April, up 4.3 percent y/y from a year ago.

Commentary –

- The euro is continuing its consolidation around key resistance of 1.12

GBP/USD –

Trading at 1.285

Trend meter –

- Long term – Sell, Medium term – Buy, Short term – Buy

Support –

- Long term – 1.16, Medium term – 1.23, Short term – 1.27

Resistance –

- Long term – 1.32, Medium term – 1.305, Short term – 1.305

Economic release today –

- Markit construction PMI improves to 56 in May.

Commentary –

- The pound remains dogged by declining margin in the polls for the Conservatives in the upcoming election, however, recovered and the best performer of the week. We expect the pound to reach parity in the longer run.

USD/JPY –

Trading at 111.4

Trend meter –

- Long term – Sell, Medium term – sell, Short term – Range

Support –

- Long term – 109, Medium term – 110, Short term – 112

Resistance –

- Long term – 119, Medium term – 115, Short term – 115

Economic release today –

- Consumer confidence improves to 43.6 in May.

Commentary –

- The yen’s performance further waned as stocks moved to new highs.

USD/CHF –

Trading at 0.971

Trend meter –

- Long term – Buy, Medium term – Range/Buy, Short term – Range

Support –

- Long term – 0.95, Medium term – 0.95, Short term – 0.95

Resistance –

- Long term – 1.08, Medium term – 1.037, Short term – 1

Economic release today –

- NIL

Commentary –

- Franc’s performance improved. It is heading for a test of 0.95 area.

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022