Dollar index trading at 99.78 (+0.15%)

Strength meter (today so far) – Euro -0.15%, Franc +0.01%, Yen +0.38%, GBP -0.52%

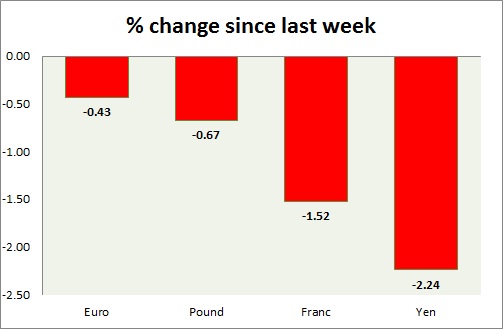

Strength meter (since last week) – Euro -0.43%, Franc -1.52%, Yen -2.24%, GBP -0.67%

EUR/USD –

Trading at 1.085

Trend meter –

- Long term – Sell, Medium term – Buy, Short term – Range

Support

- Long term – 1.032, Medium term – 1.05, Short term – 1.07

Resistance –

- Long term – 1.12, Medium term – 1.10, Short term – 1.10

Economic release today –

- NIL

Commentary –

- The euro continues to struggle below 1.09 area, despite risk rally in equities.

GBP/USD –

Trading at 1.286

Trend meter –

- Long term – Sell, Medium term – Buy, Short term – Buy

Support –

- Long term – 1.16, Medium term – 1.23, Short term – 1.27

Resistance –

- Long term – 1.32, Medium term – 1.305, Short term – 1.305

Economic release today –

- Industrial production declined by 0.5 percent in March, up 1.4 percent from a year ago.

- Manufacturing production declined 0.6 percent in March, up 2.3 percent from a year ago.

- Trade deficit deteriorated to £4.9 billion in March.

- BoE kept policy rates unchanged warned on outlook.

- Inflation report was weaker than anticipated.

Commentary –

- The pound declined sharply after weaker than expected industrial production and trade balance as BoE warns on weakness ahead. BoE inflation report was also weaker than expected. We expect the pound to reach parity in the longer run.

USD/JPY –

Trading at 113.9

Trend meter –

- Long term – Sell, Medium term – sell, Short term – Range

Support –

- Long term – 109, Medium term – 110, Short term – 112

Resistance –

- Long term – 119, Medium term – 115, Short term – 115

Economic release today –

- Eco Watchers’ survey outlook improved to 48.8 and current improved to 48.1

Commentary –

- The yen reversed some of its recent loss as President Trump fired FBI chief, James Comey.

USD/CHF –

Trading at 1.009

Trend meter –

- Long term – Buy, Medium term – Range/Buy, Short term – Range

Support –

- Long term – 0.95, Medium term – 0.95, Short term – 0.98

Resistance –

- Long term – 1.08, Medium term – 1.037, Short term – 1.037

Economic release today –

- NIL

Commentary –

- Franc weakened further below parity. Much worse performer than euro this week. Active call -Franc might decline to 1.08 per dollar. Target extended to 1.14

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022