Dollar index trading at 99.46 (+0.01%)

Strength meter (today so far) – Euro -0.15%, Franc +0.00%, Yen -0.12%, GBP +0.01%

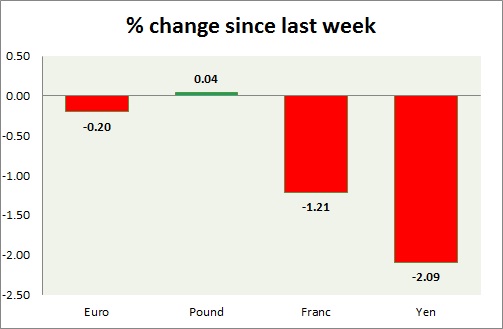

Strength meter (since last week) – Euro -0.20%, Franc -1.21%, Yen -2.09%, GBP +0.04%

EUR/USD –

Trading at 1.087

Trend meter –

- Long term – Sell, Medium term – Buy, Short term – Range

Support

- Long term – 1.032, Medium term – 1.05, Short term – 1.07

Resistance –

- Long term – 1.12, Medium term – 1.10, Short term – 1.10

Economic release today –

- NIL

Commentary –

- The euro continues to struggle despite risk rally in equities across Europe.

GBP/USD –

Trading at 1.295

Trend meter –

- Long term – Sell, Medium term – Buy, Short term – Buy

Support –

- Long term – 1.16, Medium term – 1.23, Short term – 1.27

Resistance –

- Long term – 1.32, Medium term – 1.305, Short term – 1.305

Economic release today –

- RICS house price balance report will be released at 23:00 GMT.

Commentary –

- The pound continues to hover around key 1.3 level. The strongest performer of the week so far. We expect the pound to reach parity in the longer run.

USD/JPY –

Trading at 113.8

Trend meter –

- Long term – Sell, Medium term – sell, Short term – Range

Support –

- Long term – 109, Medium term – 110, Short term – 112

Resistance –

- Long term – 119, Medium term – 115, Short term – 115

Economic release today –

- Trade balance report will be released at 23:50 GMT.

Commentary –

- The yen is the worst performer of the week so far due to risk affinity. The pair is in brief retrace after weakening past 114

USD/CHF –

Trading at 1.006

Trend meter –

- Long term – Buy, Medium term – Range/Buy, Short term – Range

Support –

- Long term – 0.95, Medium term – 0.95, Short term – 0.98

Resistance –

- Long term – 1.08, Medium term – 1.037, Short term – 1.037

Economic release today –

- NIL

Commentary –

- Franc weakened further below parity. Much worse performer than euro this week. Active call -Franc might decline to 1.08 per dollar. Target extended to 1.14

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022