Dollar index trading at 98.88 (+0.10%)

Strength meter (today so far) – Euro -0.24%, Franc -0.42%, Yen +0.19%, GBP +0.09%

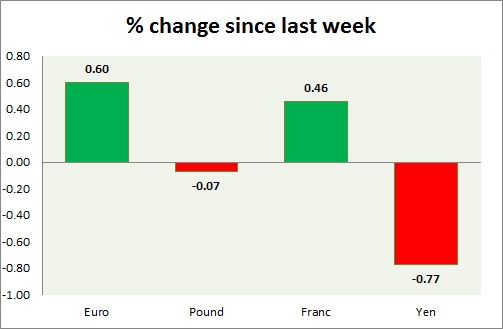

Strength meter (since last week) – Euro +0.60%, Franc +0.46%, Yen -0.77%, GBP -0.07%

EUR/USD –

Trading at 1.096

Trend meter –

- Long term – Sell, Medium term – Buy, Short term – Range/Buy

Support

- Long term – 1.032, Medium term – 1.05, Short term – 1.06

Resistance –

- Long term – 1.11, Medium term – 1.09, Short term – 1.09

Economic release today –

- NIL

Commentary –

- The euro broke above the resistance around 1.09 area as the investors take up positions ahead of the French election round two over the weekend.

GBP/USD –

Trading at 1.293

Trend meter –

- Long term – Sell, Medium term – Buy, Short term – Buy

Support –

- Long term – 1.16, Medium term – 1.23, Short term – 1.27

Resistance –

- Long term – 1.32, Medium term – 1.305, Short term – 1.305

Economic release today –

- NIL

Commentary –

- The pound is testing resistance around 1.3 area. Weakened as the EU hardened its stance towards Britain. We expect the pound to reach parity in the longer run.

USD/JPY –

Trading at 112.3

Trend meter –

- Long term – Sell, Medium term – sell, Short term – Range

Support –

- Long term – 107, Medium term – 107, Short term – 107

Resistance –

- Long term – 119, Medium term – 115, Short term – 112

Economic release today –

- NIL

Commentary –

- The yen’s performance improved since yesterday, but still the worst performer of the week so far.

USD/CHF –

Trading at 0.99

Trend meter –

- Long term – Buy, Medium term – Range/Buy, Short term – Range

Support –

- Long term – 0.95, Medium term – 0.95, Short term – 0.98

Resistance –

- Long term – 1.08, Medium term – 1.037, Short term – 1.037

Economic release today –

- Forex reserves increase to 696 billion.

Commentary –

- Franc’s is moving in line with the euro. Active call -Franc might decline to 1.08 per dollar. Target extended to 1.14

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022