Dollar index trading at 99.98 (+0.00%)

Strength meter (today so far) – Euro +0.07%, Franc +0.01%, Yen -0.18%, GBP +0.39%

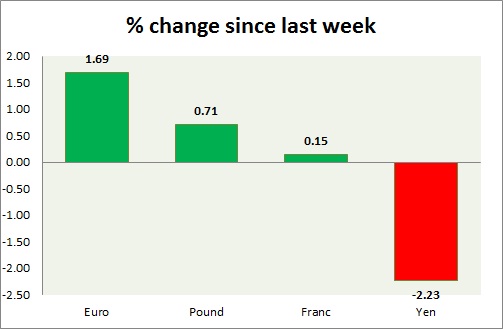

Strength meter (since last week) – Euro +1.69%, Franc +0.15%, Yen -2.23%, GBP +0.71%

EUR/USD –

Trading at 1.089

Trend meter –

- Long term – Sell, Medium term – Buy, Short term – Range/Buy

Support

- Long term – 1.032, Medium term – 1.05, Short term – 1.06

Resistance –

- Long term – 1.11, Medium term – 1.09, Short term – 1.09

Economic release today –

- Services sentiment improved to 14.2 in April.

- Consumer confidence remained flat at -3.2

- Industrial confidence improves to 2.6

- Business climate improves to 1.09 in April.

- Economic sentiment improves to 109.6

- ECB kept monetary policy unchanged with the deposit rate at -0.4 percent.

Commentary –

- The euro is the best performer of the week on French election outcome, flirting with the key resistance around 1.09 area. The focus is on ECB press conference.

GBP/USD –

Trading at 1.289

Trend meter –

- Long term – Sell, Medium term – Buy, Short term – Buy

Support –

- Long term – 1.16, Medium term – 1.23, Short term – 1.27

Resistance –

- Long term – 1.32, Medium term – 1.305, Short term – 1.305

Economic release today –

- CBI trade survey index improves to 38 percent.

- GFK consumer confidence report will be released at

Commentary –

- The pound’s performance improved since yesterday. We expect the pound to reach parity in the longer run.

USD/JPY –

Trading at 111.3

Trend meter –

- Long term – Sell, Medium term – sell, Short term – Range

Support –

- Long term – 107, Medium term – 107, Short term – 107

Resistance –

- Long term – 119, Medium term – 115, Short term – 112

Economic release today –

- BoJ kept monetary policy unchanged and the interest rate at -0.1 percent.

- National and Tokyo CPI report will be released at 23:30 GMT, along with unemployment report.

- Retail trade report and industrial production report will be released at 23:50 GMT.

Commentary –

- The yen is the worst performer this week as the French Election outcome reduced demand for a safe haven, however, performance improved since yesterday.

USD/CHF –

Trading at 0.994

Trend meter –

- Long term – Buy, Medium term – Range/Buy, Short term – Range

Support –

- Long term – 0.95, Medium term – 0.95, Short term – 0.98

Resistance –

- Long term – 1.08, Medium term – 1.037, Short term – 1.037

Economic release today –

- Trade balance for March came at 3.1 billion.

Commentary –

- Franc is much worse performer this week compared to the euro. Active call -Franc might decline to 1.08 per dollar. Target extended to 1.14

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed