Dollar index trading at 99.06 (+0.02%)

Strength meter (today so far) – Euro +0.21%, Franc +0.07%, Yen -0.99%, GBP +0.34%

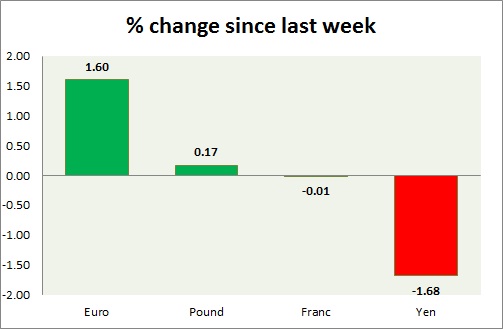

Strength meter (since last week) – Euro +1.60%, Franc -0.01%, Yen -1.68%, GBP +0.17%

EUR/USD –

Trading at 1.089

Trend meter –

- Long term – Sell, Medium term – Sell, Short term – Range

Support

- Long term – 1.032, Medium term – 1.05, Short term – 1.06

Resistance –

- Long term – 1.11, Medium term – 1.09, Short term – 1.09

Economic release today –

- NIL

Commentary –

- The euro is the best performer of the week as pro-EU candidate Emmanuel Macron comes first in the first round of French election. The euro is testing key resistance around 1.09 area.

GBP/USD –

Trading at 1.282

Trend meter –

- Long term – Sell, Medium term – Buy, Short term – Buy

Support –

- Long term – 1.16, Medium term – 1.23, Short term – 1.27

Resistance –

- Long term – 1.32, Medium term – 1.305, Short term – 1.305

Economic release today –

- Public sector net borrowing came at £4.365 billion.

Commentary –

- The pound is only marginally higher this week. We expect the pound to reach parity in the longer run.

USD/JPY –

Trading at 110.8

Trend meter –

- Long term – Sell, Medium term – sell, Short term – Sell

Support –

- Long term – 107, Medium term – 107, Short term – 107

Resistance –

- Long term – 119, Medium term – 115, Short term – 112

Economic release today –

- NIL

Commentary –

- The yen is the worst performer of the outcome as the French Election outcome reduces demand for safe haven.

USD/CHF –

Trading at 0.995

Trend meter –

- Long term – Buy, Medium term – Range/Buy, Short term – Range

Support –

- Long term – 0.95, Medium term – 0.95, Short term – 0.98

Resistance –

- Long term – 1.08, Medium term – 1.037, Short term – 1.037

Economic release today –

- NIL

Commentary –

- Franc is much worse performer this week compared to the euro. Active call -Franc might decline to 1.08 per dollar. Target extended to 1.14

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022