Dollar index trading at 99.62 (-0.18%)

Strength meter (today so far) – Euro +0.28%, Franc +0.21%, Yen -0.22%, GBP +0.10%

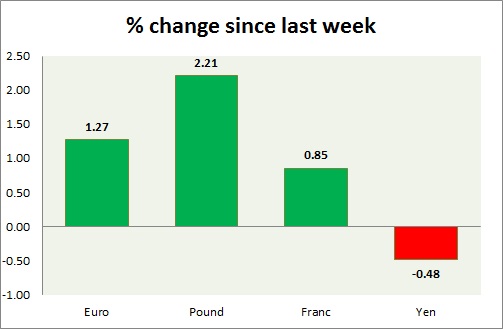

Strength meter (since last week) – Euro +1.27%, Franc +0.85%, Yen -0.48%, GBP +2.21%

EUR/USD –

Trading at 1.074

Trend meter –

- Long term – Sell, Medium term – Sell, Short term – Range

Support

- Long term – 1.032, Medium term – 1.05, Short term – 1.06

Resistance –

- Long term – 1.09, Medium term – 1.085, Short term – 1.085

Economic release today –

- NIL

Commentary –

- The euro is up on weaker dollar but still trading within range.

GBP/USD –

Trading at 1.279

Trend meter –

- Long term – Sell, Medium term – Buy, Short term – Buy

Support –

- Long term – 1.16, Medium term – 1.23, Short term – 1.27

Resistance –

- Long term – 1.32, Medium term – 1.305, Short term – 1.305

Economic release today –

- BoE governor Mark Carney is scheduled to speak at 15:30 GMT.

Commentary –

- The pound is giving some of its gains made after UK election announcement. We expect the pound to reach parity in the longer run.

USD/JPY –

Trading at 109.1

Trend meter –

- Long term – Sell, Medium term – sell, Short term – Sell

Support –

- Long term – 107, Medium term – 107, Short term – 107

Resistance –

- Long term – 119, Medium term – 115, Short term – 112

Economic release today –

- NIL.

Commentary –

- The yen is the worst performer of the week as it gives up some of the grounds gained last week on easing geopolitical tensions.

USD/CHF –

Trading at 0.996

Trend meter –

- Long term – Buy, Medium term – Range/Buy, Short term – Range

Support –

- Long term – 0.95, Medium term – 0.95, Short term – 0.98

Resistance –

- Long term – 1.08, Medium term – 1.037, Short term – 1.037

Economic release today –

- NIL

Commentary –

- Franc is a relatively worse performer than the euro this week. Active call - Franc might decline to 1.08 per dollar. Target extended to 1.14

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX