Dollar index trading at 100.84 (-0.17%)

Strength meter (today so far) – Euro +0.17%, Franc +0.10%, Yen +0.07%, GBP +0.02%

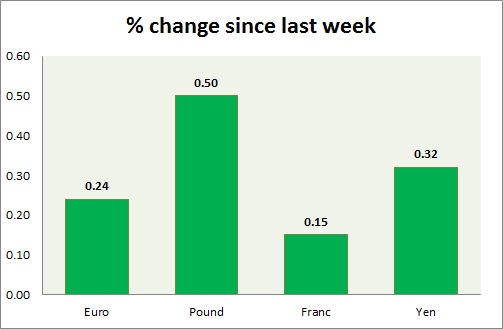

Strength meter (since last week) – Euro +0.24%, Franc +0.15%, Yen +0.32%, GBP +0.50%

EUR/USD –

Trading at 1.061

Trend meter –

- Long term – Sell, Medium term – Sell, Short term – Sell

Support

- Long term – 1.032, Medium term – 1.05, Short term – 1.06

Resistance –

- Long term – 1.09, Medium term – 1.085, Short term – 1.085

Economic release today –

- Industrial production grew 1.2 percent y/y in February.

- Zew survey economic sentiment improved to 26.3 in April.

Commentary –

- The euro looking to recover losses from last week, however, downside pressure intact due to upcoming French election.

GBP/USD –

Trading at 1.243

Trend meter –

- Long term – Sell, Medium term – Sell, Short term – range/sell

Support –

- Long term – 1.16, Medium term – 1.2, Short term – 1.2

Resistance –

- Long term – 1.32, Medium term – 1.27, Short term – 1.27

Economic release today –

- Retail price up 3.1 percent y/y in March.

- House price index is up 5.8 percent y/y in March.

- Producer price output is 3.6 percent y/y.

- Producer price index input is up 17.9 percent y/y.

- Consumer price index is up 2.3 percent y/y.

Commentary –

- The pound remains the best performer of the day. We expect the pound to reach parity in the longer run.

USD/JPY –

Trading at 110.6

Trend meter –

- Long term – Sell, Medium term – Range/ Buy, Short term – Range/Buy

Support –

- Long term – 107, Medium term – 109, Short term – 109

Resistance –

- Long term – 121, Medium term – 119, Short term – 115

Economic release today –

- Machine tools orders up 22.6 percent y/y in March.

- Domestic corporate goods price index will be updated at 23:50 GMT.

- Machinery orders report for February will be published at 23:50 GMT.

Commentary –

- The yen is heading to test resistance around 110 per dollar.

USD/CHF –

Trading at 1.007

Trend meter –

- Long term – Buy, Medium term – Range/Buy, Short term – Range

Support –

- Long term – 0.95, Medium term – 0.95, Short term – 0.98

Resistance –

- Long term – 1.08, Medium term – 1.037, Short term – 1.037

Economic release today –

- NIL

Commentary –

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022