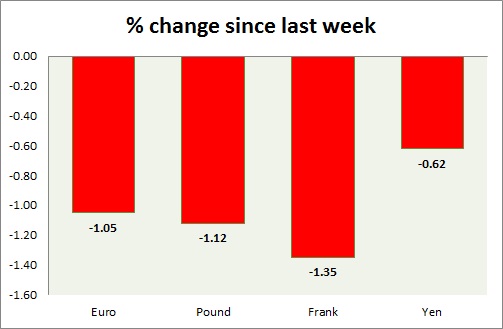

Dollar is treading water after yesterday's sharp gain over stronger durable goods order and rise in weekly wages. The performance remained mixed against the majors (EUR, GBP, JPY, & CHF) so far this week. A chart and table is attached for explanation.

- Euro now the worst performer this week surpassing franc, dropped sharply last night after the data in US showed strong momentum. Today inflation data from Spain, Italy & Greece showed further contraction. GDP growth was positive in Greece but weaker than before at 1.2%. Portugal also registered similar GDP at 0.7% YoY. b US GDP & German CPI today remain the focus next. Currently trading at 1.122. Immediate Support lies at 1.11 & Resistance 1.127.

- Pound, still the best performer this week has no event risk scheduled today but facing strong headwinds and bears have tried to break below 1.54 several times. Despite the weakness yesterday, found is expected to do fairly well among peers. Currently trading at 1.543. Immediate Support lies at 1.535 & Resistance 1.56.

- Yen continue the range unimpressed by inflation & unemployment data. Unemployment ticked up to 3.6% and CPI excluding the tax effect remains weak at 0.2%.US GDP to be released at 13:30 GMT could provide further queue. Currently trading at 119.3. Immediate Support lies at 118.2 & Resistance 120.5.

- Franc has started to stabilize and failing to break above its immediate resistance. Momentum could come back once the level is broken. Currently trading at 0.953. Immediate Support lies at 0.937 & Resistance 0.954. The pair may break above and move towards its target of 0.976.

|

Euro |

-1.36% |

|

Pound |

0.25% |

|

Frank |

-1.35% |

|

Yen |

-0.34% |

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate