Dollar index trading at 98.90 (-0.69%)

Strength meter (today so far) – Euro +0.74%, Franc +0.66%, Yen +0.85%, GBP +0.98%

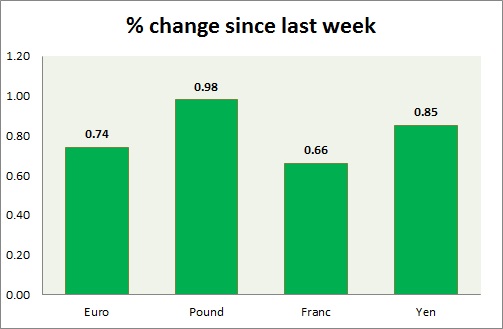

Strength meter (since last week) – Euro +0.74%, Franc +0.66%, Yen +0.85%, GBP +0.98%

EUR/USD –

Trading at 1.087

Trend meter –

- Long term – Sell, Medium term – Sell, Short term – Sell

Support

- Long term – 1.032, Medium term – 1.05, Short term – 1.06

Resistance –

- Long term – 1.09, Medium term – 1.085, Short term – 1.085

Economic release today –

- Private loans up 2.3 percent y/y in February.

- M3 money supply up 4.7 percent y/y in February, down 0.1 percent from the previous month.

Commentary –

- The euro is heading higher as the dollar weakens across board.

GBP/USD –

Trading at 1.259

Trend meter –

- Long term – Sell, Medium term – Sell, Short term – range/sell

Support –

- Long term – 1.16, Medium term – 1.2, Short term – 1.2

Resistance –

- Long term – 1.32, Medium term – 1.27, Short term – 1.25 (broken)

Economic release today –

- NIL

Commentary –

- The pound cleared 1.25 resistance area and heading for a test of 1.27 area. We expect the pound to reach parity in the longer run.

USD/JPY –

Trading at 110.3

Trend meter –

- Long term – Sell, Medium term – Range/ Buy, Short term – Range/Buy

Support –

- Long term – 107, Medium term – 109, Short term – 109

Resistance –

- Long term – 121, Medium term – 119, Short term – 115

Economic release today –

- NIL

Commentary –

- The yen is in line with its peers. 110 area likely to be key resistance Active call – Yen likely to reach 120 as key support broken.

USD/CHF –

Trading at 0.984

Trend meter –

- Long term – Buy, Medium term – Range/Buy, Short term – Range

Support –

- Long term – 0.95, Medium term – 0.95, Short term – 0.98

Resistance –

- Long term – 1.08, Medium term – 1.037, Short term – 1.037

Economic release today –

- NIL

Commentary –

- As expected, the franc is heading for a test of 0.98 area. Active call -Franc might decline to 1.08 per dollar. Target extended to 1.14

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX