Dollar index trading at 99.73 (-0.03%)

Strength meter (today so far) – Euro +0.15%, Franc +0.09%, Yen -0.01%, GBP -0.27%

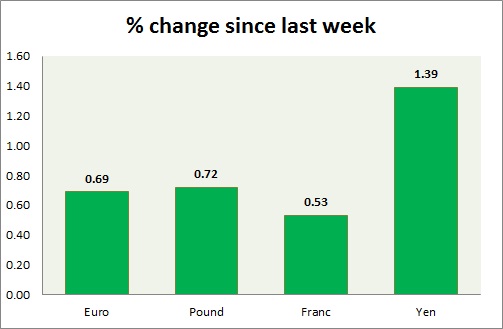

Strength meter (since last week) – Euro +0.69%, Franc +0.53%, Yen +1.39%, GBP +0.72%

EUR/USD –

Trading at 1.08

Trend meter –

- Long term – Sell, Medium term – Sell, Short term – Sell

Support

- Long term – 1.032, Medium term – 1.05, Short term – 1.06

Resistance –

- Long term – 1.09, Medium term – 1.085, Short term – 1.085

Economic release today –

- Market manufacturing PMI improves to 56.2 and services PMI improves to 56.5

Commentary –

- The euro is likely to move higher as the dollar remains battered. The focus is on French election.

GBP/USD –

Trading at 1.248

Trend meter –

- Long term – Sell, Medium term – Sell, Short term – range/sell

Support –

- Long term – 1.16, Medium term – 1.2, Short term – 1.2

Resistance –

- Long term – 1.32, Medium term – 1.27, Short term – 1.25

Economic release today –

- BBA mortgage approvals for January declines to 42,613.

Commentary –

- The pound is testing 1.25 resistance area. We expect the pound to reach parity in the longer run.

USD/JPY –

Trading at 111

Trend meter –

- Long term – Sell, Medium term – Range/ Buy, Short term – Range/Buy

Support –

- Long term – 107, Medium term – 109, Short term – 112

Resistance –

- Long term – 121, Medium term – 119, Short term – 115

Economic release today –

- Nikkei manufacturing PMI marginally declines to 52.6 in March from 53.3 in February.

- Coincident index marginally declined to 115.1 in January and leading economic index marginally improves to 104.9

Commentary –

- The yen is the best performer on weaker dollar and risk aversion, despite easing pledge from Kuroda. Active call – Yen likely to reach 120 as key support broken.

USD/CHF –

Trading at 0.992

Trend meter –

- Long term – Buy, Medium term – Range/Buy, Short term – Range

Support –

- Long term – 0.95, Medium term – 0.95, Short term – 0.98

Resistance –

- Long term – 1.08, Medium term – 1.037, Short term – 1.037

Economic release today –

- NIL

Commentary –

- Franc is looking to test key resistance around 0.98 area. It is up for the week against the dollar but also the weakest performer. Active call -Franc might decline to 1.08 per dollar. Target extended to 1.14

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022