Dollar index trading at 100.63 (+0.08%)

Strength meter (today so far) – Euro -0.10%, Franc +0.24%, Yen +0.01%, GBP -0.12%

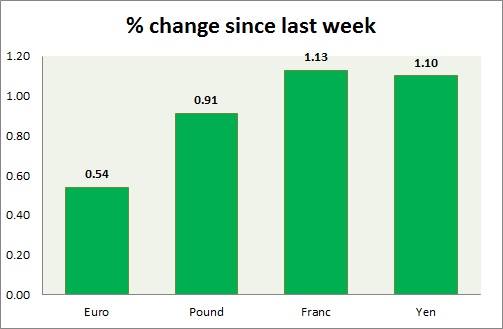

Strength meter (since last week) – Euro +0.54%, Franc +1.13%, Yen +1.10%, GBP +1.46%

EUR/USD –

Trading at 1.073

Trend meter –

- Long term – Sell, Medium term – Sell, Short term – Sell

Support

- Long term – 1.01, Medium term – 1.032, Short term – 1.032

Resistance –

- Long term – 1.09, Medium term – 1.075, Short term – 1.072

Economic release today –

- Consumer price index up 2 percent y/y in February.

Commentary –

- The euro is at more than a month high cheering Dutch election, where incumbent Prime Minister Mark Rutte’s VVD became the biggest party.

GBP/USD –

Trading at 1.233

Trend meter –

- Long term – Sell, Medium term – Sell, Short term – range/sell

Support –

- Long term – 1.16, Medium term – 1.2, Short term – 1.2

Resistance –

- Long term – 1.32, Medium term – 1.27, Short term – 1.25

Economic release today –

- BoE kept interest rate unchanged at today’s meeting, however one member voted for a hike.

Commentary –

- The pound rose sharply as one member in BoE voted for a hike. We expect the pound to reach parity in the longer run.

USD/JPY –

Trading at 113.4

Trend meter –

- Long term – Sell, Medium term – Range/ Buy, Short term – Range/Buy

Support –

- Long term – 107, Medium term – 109, Short term – 112

Resistance –

- Long term – 121, Medium term – 119, Short term – 115

Economic release today –

- BoJ kept the interest rate at -0.1 percent.

Commentary –

- The yen strengthened as the dollar weakened post FOMC. Active call – Yen likely to reach 120 as key support broken.

USD/CHF –

Trading at 0.998

Trend meter –

- Long term – Buy, Medium term – Range/Buy, Short term – Range

Support –

- Long term – 0.95, Medium term – 0.95, Short term – 0.98

Resistance –

- Long term – 1.08, Medium term – 1.037, Short term – 1.037

Economic release today –

- NIL

Commentary –

- Franc is top performer of the week as SNB adds hawkish comments in monetary policy statement and due to weaker dollar. Active call -Franc might decline to 1.08 per dollar. Target extended to 1.14

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX