Dollar index trading at 101.5 (+0.30%)

Strength meter (today so far) – Euro -0.31%, Franc -0.33%, Yen -0.23%, GBP -0.30%

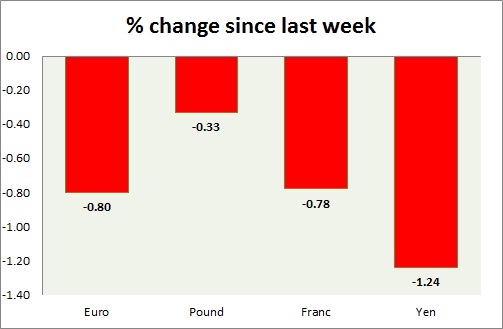

Strength meter (since last week) – Euro -0.80%, Franc -0.78%, Yen -1.24%, GBP -0.33%

EUR/USD –

Trading at 1.054

Trend meter –

- Long term – Sell, Medium term – Sell, Short term – Sell

Support

- Long term – 1.01, Medium term – 1.032, Short term – 1.032

Resistance –

- Long term – 1.11, Medium term – 1.084, Short term – 1.084

Economic release today –

- Trade balance for December came at €28.1 billion.

Commentary –

- The euro declined sharply as the Fed Chair Janet Yellen kept the door open for a hike in March and due to uncertainties with regard to election outcomes in Europe.

GBP/USD –

Trading at 1.243

Trend meter –

- Long term – Sell, Medium term – Sell, Short term – range/buy

Support –

- Long term – 1.16, Medium term – 1.2, Short term – 1.2

Resistance –

- Long term – 1.32, Medium term – 1.27, Short term – 1.27

Economic release today –

- Unemployment rate came at 4.8 percent but earnings growth declined to 2.6 percent.

Commentary –

- The pound is the best performer of the group but down against the dollar. We expect the pound to reach parity in the longer run.

USD/JPY –

Trading at 114.5

Trend meter –

- Long term – Sell, Medium term – Range/ Buy, Short term – sell

Support –

- Long term – 98, Medium term – 105, Short term – 112

Resistance –

- Long term – 121, Medium term – 120, Short term – 119

Economic release today –

- NIL

Commentary –

- The yen is the worst performer of the week so far on fading risk aversion and a stronger dollar.

USD/CHF –

Trading at 1.009

Trend meter –

- Long term – Buy, Medium term – Range/Buy, Short term – Range/sell

Support –

- Long term – 0.95, Medium term – 0.95, Short term – 0.98

Resistance –

- Long term – 1.08, Medium term – 1.037, Short term – 1.037

Economic release today –

- NIL

Commentary –

- Franc is back testing parity, likely to weaken further against the dollar in the longer run. Active call -Franc might decline to 1.08 per dollar. Target extended to 1.14