Dollar index trading at 100.77 (-0.23%)

Strength meter (today so far) – Euro +0.26%, Franc +0.23%, Yen +0.28%, GBP -0.35%

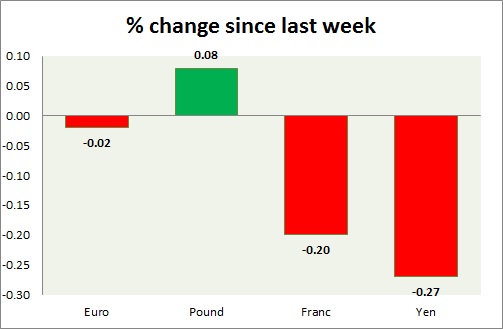

Strength meter (since last week) – Euro -0.02%, Franc -0.20%, Yen -0.27%, GBP +0.08%

EUR/USD –

Trading at 1.063

Trend meter –

- Long term – Sell, Medium term – Sell, Short term – Sell

Support

- Long term – 1.01, Medium term – 1.032, Short term – 1.032

Resistance –

- Long term – 1.11, Medium term – 1.084, Short term – 1.084

Economic release today –

- Flash reading showed GDP rose by 1.7 percent in the fourth quarter.

- Industrial production is up 2 percent y/y.

- Zew survey economic sentiment deteriorated to 17.1 in February from 23.2 in January.

Commentary –

- The euro remains downbeat as Trump’s tax speculation is keeping the dollar uplifted. Yellen’s comments in focus today.

GBP/USD –

Trading at 1.248

Trend meter –

- Long term – Sell, Medium term – Sell, Short term – range/buy

Support –

- Long term – 1.16, Medium term – 1.2, Short term – 1.2

Resistance –

- Long term – 1.32, Medium term – 1.27, Short term – 1.27

Economic release today –

- Retail price index (RPI) in the UK jumped to 2.6 percent y/y in January. Producer price index for output rose by 3.5 percent y/y. Weak pound pushed the input cost to rise 20.5 percent y/y. House price index is up 7.2 percent y/y. Compared to the above the rise in consumer price index was small, it rose by 1.8 percent y/y.

Commentary –

- The pound suffered blow as consumer price index gain failed to impress. We expect the pound to reach parity in the longer run.

USD/JPY –

Trading at 113.4

Trend meter –

- Long term – Sell, Medium term – Range/ Buy, Short term – sell

Support –

- Long term – 98, Medium term – 105, Short term – 112

Resistance –

- Long term – 121, Medium term – 120, Short term – 119

Economic release today –

- NIL

Commentary –

- The yen remains downbeat over Trump-Abe good meeting . Active call- Sell USD/JPY targeting 110.

USD/CHF –

Trading at 1.003

Trend meter –

- Long term – Buy, Medium term – Range/Buy, Short term – Range/sell

Support –

- Long term – 0.95, Medium term – 0.95, Short term – 0.98

Resistance –

- Long term – 1.08, Medium term – 1.037, Short term – 1.037

Economic release today –

- In Switzerland, the economy returned to positive yearly inflation for first time since 2014. There consumer price rose by 0.3 percent y/y. producer and import prices rose by 0.8 percent y/y.

Commentary –

- Franc is back testing parity, likely to weaken further against the dollar in the longer run. Active call -Franc might decline to 1.08 per dollar. Target extended to 1.14

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022