Dollar index trading at 100.66 (+0.77%)

Strength meter (today so far) – Euro -0.70%, Franc -0.86%, Yen -0.57%, GBP -0.87%

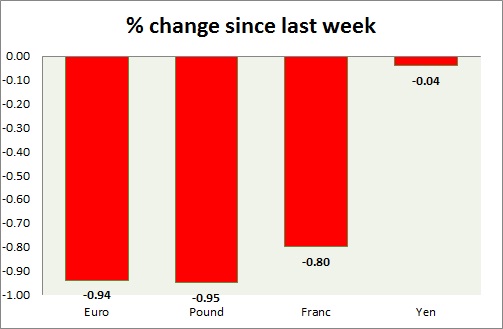

Strength meter (since last week) – Euro -0.94%, Franc -0.80%, Yen -0.04%, GBP -0.95%

EUR/USD –

Trading at 1.067

Trend meter –

- Long term – Sell, Medium term – Sell, Short term – Sell

Support

- Long term – 1.01, Medium term – 1.032, Short term – 1.032

Resistance –

- Long term – 1.11, Medium term – 1.084, Short term – 1.084

Economic release today –

- Sentix investor confidence came at 17.4 in February.

Commentary –

- The euro declined sharply as March hike from Fed comes into focus and uncertainties surrounding French election rise.

GBP/USD –

Trading at 1.237

Trend meter –

- Long term – Sell, Medium term – Sell, Short term – range/buy

Support –

- Long term – 1.16, Medium term – 1.2, Short term – 1.2

Resistance –

- Long term – 1.32, Medium term – 1.27, Short term – 1.27

Economic release today –

- Halifax house prices down 0.9 percent in January, up 2.4 percent from a year ago.

Commentary –

- The pound is focused on the upcoming Brexit debate this week. Sliding down in the face of a stronger dollar. We expect the pound to reach parity in the longer run.

USD/JPY –

Trading at 112.4

Trend meter –

- Long term – Sell, Medium term – Range/ Buy, Short term – sell

Support –

- Long term – 98, Medium term – 105, Short term – 112

Resistance –

- Long term – 121, Medium term – 120, Short term – 119

Economic release today –

- Coincident index rose to 115.2 and leading economic index rose to 105.2 in December.

- December trade balance data will be published at 23:50 GMT.

- BoJ will release summary of opinions at 23:50 GMT.

Commentary –

- The yen remains the best performer among majors but down against the dollar. Active call- Sell USD/JPY targeting 110.

USD/CHF –

Trading at 0.999

Trend meter –

- Long term – Buy, Medium term – Range/Buy, Short term – Range/sell

Support –

- Long term – 0.95, Medium term – 0.95, Short term – 0.98

Resistance –

- Long term – 1.08, Medium term – 1.037, Short term – 1.037

Economic release today –

- SECO consumer climate improves to -3 from -13

- Swiss FX reserve declines to 644 billion.

Commentary –

- Franc is likely to weaken against the dollar in the longer run. Active call -Franc might decline to 1.08 per dollar. Target extended to 1.14

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX