Dollar index trading at 99.33 (-0.36%)

Strength meter (today so far) – Euro +0.34%, Franc +0.48%, Yen +0.67%, GBP -0.03%

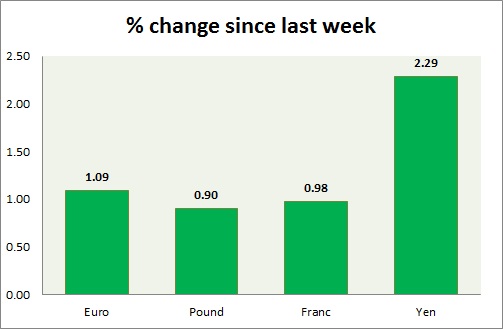

Strength meter (since last week) – Euro +1.09%, Franc +0.98%, Yen +2.29%, GBP +0.90%

EUR/USD –

Trading at 1.08

Trend meter –

- Long term – Sell, Medium term – Sell, Short term – Sell

Support

- Long term – 1.01, Medium term – 1.032, Short term – 1.032

Resistance –

- Long term – 1.11, Medium term – 1.084, Short term – 1.084

Economic release today –

- Producer price index rose 1.6 percent y/y.

Commentary –

- The euro is heading higher to test key resistance around 1.085 as the dollar declines after Fed. Active call – Sell EUR/USD at 1.116 with stop loss at 1.15 and target at 1.01. stop loss revised to 1.13

GBP/USD –

Trading at 1.266

Trend meter –

- Long term – Sell, Medium term – Sell, Short term – range/buy

Support –

- Long term – 1.16, Medium term – 1.2, Short term – 1.2

Resistance –

- Long term – 1.32, Medium term – 1.27, Short term – 1.27

Economic release today –

- Construction PMI declined to 52.2 in January.

- BoE unanimously voted in favor of keeping rates steady.

Commentary –

- The pound rose further despite the Brexit legislation passing through the government. We expect the pound to reach parity in the longer run.

USD/JPY –

Trading at 112.4

Trend meter –

- Long term – Sell, Medium term – Range/ Buy, Short term – sell

Support –

- Long term – 98, Medium term – 105, Short term – 112

Resistance –

- Long term – 121, Medium term – 120, Short term – 119

Economic release today –

- Consumer confidence rose to 43.2 in January.

- BoJ will release monetary policy minutes at 23:50 GMT.

Commentary –

- The yen rose further and the best performer of the week as equities decline. Active call- Sell USD/JPY targeting 110.

USD/CHF –

Trading at 0.988

Trend meter –

- Long term – Buy, Medium term – Range/Buy, Short term – Range/sell

Support –

- Long term – 0.95, Medium term – 0.95, Short term – 0.98

Resistance –

- Long term – 1.08, Medium term – 1.037, Short term – 1.037

Economic release today –

- Retail sales declined 3.5 percent y/y.

Commentary –

- Franc is up in line with the euro, the pair is likely to decline towards 0.98 area in the very near term. Active call -Franc might decline to 1.08 per dollar. Target extended to 1.14

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed