Dollar index trading at 100.27 (+0.36%)

Strength meter (today so far) – Euro -0.22%, Franc +0.17%, Yen -0.85%, GBP -0.44%

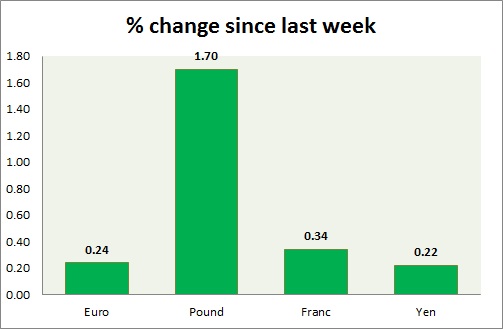

Strength meter (since last week) – Euro +0.24%, Franc +0.34%, Yen +0.22%, GBP +1.70%

EUR/USD –

Trading at 1.072

Trend meter –

- Long term – Sell, Medium term – Sell, Short term – Sell

Support

- Long term – 1.01, Medium term – 1.032, Short term – 1.032

Resistance –

- Long term – 1.11, Medium term – 1.084, Short term – 1.084

Economic release today –

- NIL

Commentary –

- The euro is taking cue from dollar’s strength and weakness for the time being. Active call – Sell EUR/USD at 1.116 with stop loss at 1.15 and target at 1.01. stop loss revised to 1.13

GBP/USD –

Trading at 1.258

Trend meter –

- Long term – Sell, Medium term – Sell, Short term – range/buy

Support –

- Long term – 1.16, Medium term – 1.2, Short term – 1.2

Resistance –

- Long term – 1.32, Medium term – 1.27, Short term – 1.27

Economic release today –

- BBA mortgage approvals in December rose to 43,228

- Flash reading showed GDP rose by 0.6 percent in the fourth quarter, up 2.2 percent from a year ago.

Commentary –

- The pound remains the only super performer this week. We expect the pound to reach parity.

USD/JPY –

Trading at 114.3

Trend meter –

- Long term – Sell, Medium term – Range/ Buy, Short term – sell

Support –

- Long term – 98, Medium term – 105, Short term – 112

Resistance –

- Long term – 121, Medium term – 120, Short term – 119

Economic release today –

- Tokyo CPI for January and National CPI for December will be released at 23:30 GMT.

Commentary –

- The yen lost its sheen as the equity market outperforms. Active call- Sell USD/JPY targeting 110.

USD/CHF –

Trading at 0.997

Trend meter –

- Long term – Buy, Medium term – Range/Buy, Short term – Range/sell

Support –

- Long term – 0.95, Medium term – 0.95, Short term – 0.98

Resistance –

- Long term – 1.08, Medium term – 1.037, Short term – 1.037

Economic release today –

- Trade balance for December came at $2.7 billion.

Commentary –

- Franc is treading water around parity; it is the worst performer of the week, the pair is likely to decline towards 0.98 area in the very near term. Active call -Franc might decline to 1.08 per dollar. Target extended to 1.14

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX