Dollar index trading at 100.66 (+0.40%)

Strength meter (today so far) – Euro -0.24%, Franc -0.06%, Yen -0.74%, GBP -0.90%

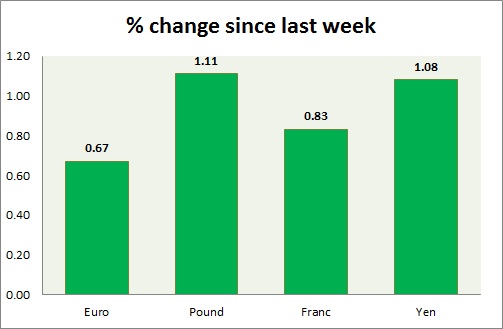

Strength meter (since last week) – Euro +0.67%, Franc +0.83%, Yen +1.08%, GBP +1.11%

EUR/USD –

Trading at 1.069

Trend meter –

- Long term – Sell, Medium term – Sell, Short term – Sell

Support

- Long term – 1.01, Medium term – 1.032, Short term – 1.032

Resistance –

- Long term – 1.11, Medium term – 1.087, Short term – 1.067

Economic release today –

- Consumer prices rose by 1.1 percent y/y in December. Core prices rose by 0.9 percent y/y.

Commentary –

- Euro has broken above previous high around 1.066 and likely to extend gains further. The focus is on ECB meeting tomorrow. Active call – Sell EUR/USD at 1.116 with stop loss at 1.15 and target at 1.01. stop loss revised to 1.13

GBP/USD –

Trading at 1.23

Trend meter –

- Long term – Sell, Medium term – Sell, Short term – range

Support –

- Long term – 1.16, Medium term – 1.2, Short term – 1.2

Resistance –

- Long term – 1.32, Medium term – 1.27, Short term – 1.27

Economic release today –

- Unemployment rate came at 4.8 percent for three months to November. Earnings increased by 2.8 percent including bonus and by 2.7 percent excluding it.

Commentary –

- The pound is still the best performer of the week but facing heavy selling pressure after reaching prior high around 1.244 area. We expect the pound to reach parity.

USD/JPY –

Trading at 113.4

Trend meter –

- Long term – Sell, Medium term – Range/ Buy, Short term – sell

Support –

- Long term – 98, Medium term – 105, Short term – 112

Resistance –

- Long term – 121, Medium term – 120, Short term – 119

Economic release today –

- NIL

Commentary –

- The yen scaled back some of the gains, yet remain well supported due to risk aversion from policy uncertainties. Active call- Sell USD/JPY targeting 110.

USD/CHF –

Trading at 1.002

Trend meter –

- Long term – Buy, Medium term – Range/Buy, Short term – Range/sell

Support –

- Long term – 0.95, Medium term – 0.95, Short term – 1

Resistance –

- Long term – 1.08, Medium term – 1.037, Short term – 1.037

Economic release today –

- NIL

Commentary –

- Franc is hovering around parity, the pair likely to decline towards 0.98 area in the very near term. Active call -Franc might decline to 1.08 per dollar. Target extended to 1.14

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX